“Bubble Watch” digs into trends that may indicate economic and/or housing market troubles ahead.

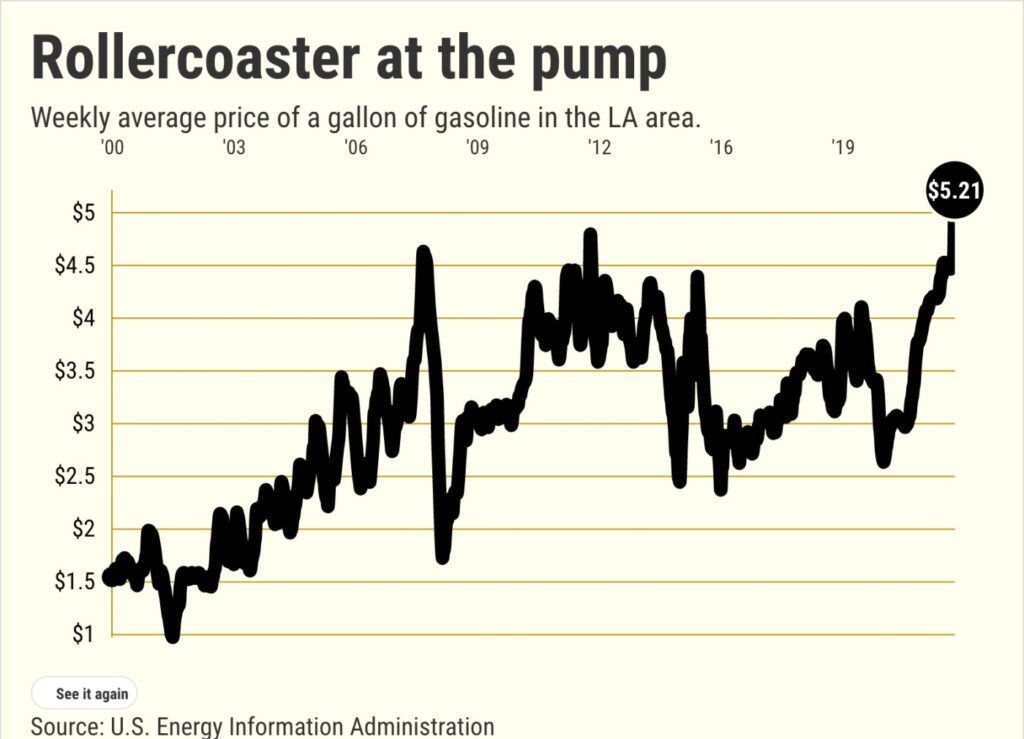

Buzz: Southern California gasoline prices broke the $5 barrier in March’s first week, smashing a record high that had stood for nearly a decade. But what do today’s pump prices mean in the long run for the economy?

Source: My trusty spreadsheet looked at the economic impact of pump prices using benchmarks that stretch back 40 years to the last great inflationary era of the 1980s. The analysis ends with 2019, avoiding any pandemic-related gyrations seeping into the math.

The Trend

Russia’s invasion of Ukraine raises questions about global oil supplies. A rapidly recovering economy created numerous reasons for folks to drive and fly, boosting demand for fuel. So, gasoline jumped an average 53 cents to $5.20 a gallon — topping the old peak of $4.74 set in October 2012.

The economic yardsticks pondered:

Gas: Gas prices in the Los Angeles area showed 3.4% annualized gains since 1979, according to the federal price index. Fuel went from 94 cents a gallon 40 years ago to $3.58 in 2019. Ah, the good old days! Extremes? The most painful year was a gas-price jump of 35% in 1980 vs. a 24% decline in 1995.

Unemployment: The California jobless rate went from 6.2% in 1979 to 4.3% in 2019. Biggest changes? From rocketing 12.5% higher in 2010 to tumbling 4.2% in 2012.

Home values: A federal index of values statewide showed 5.1% annualized gains in 40 years. Extreme value changes? A 24% hike in 2005 and a 20% decline in 2007.

Rents: An average of the rent slice of local Consumer Prices indexes for Los Angeles-Orange County, the Bay Area and San Diego shows 4.6% annualized gains over four decades. Extremes? Up 11% in 1980 and down 0.1% in 1992.

The Dissection

Local gas prices since 1980 have increased roughly half the time: up in 21 years vs. down in 19. But those jumps are higher than the depths of the drops. An average up year saw a 14% gain while the average dip was a 7% decline.

That helps explain fuel’s long-running upswing. Yet when look at the shorter run, pricier gas often precedes a chill in the following year’s economy. The inflationary whack to the wallet has widespread implications.

Unemployment: After a 12-month increase in gas prices, California joblessness rose the next year 43% of the time as unemployment increased 0.22 percentage points after these costlier fuel years. Compare that with what followed years when gas was down: Unemployment rose only 22% of the time, and overall, these years averaged an 0.4 point decline.

Home values: The year after gas increased, California house prices gained an average 3.8% since 1980 vs. 6.9% in years following falling fuel costs.

Rents: Golden State landlords upped rents on average 4.3% the year after fuel got pricier vs. 4.6% rent hikes following a cheaper year at the pumps.

How bubbly?

On a scale of zero bubbles (no bubble here) to five bubbles (five-alarm warning) … FOUR BUBBLES!

Red-hot economies like 2022’s often can’t handle many hiccups, such as unexpected inflationary injuries. And one factor in recent soaring gasoline inflation is a robust, broad-based economic expansion that is allowing many folks to successfully absorb record-high fuel prices — so far.

Don’t forget, though, that higher fuel costs hit consumers not only when filling up. Pricey oil increases the costs to produce and deliver numerous goods, both as raw material to transportation expenses.

All this inflation anxiety will also further solidify the Federal Reserve’s resolve to hike the interest rates — tacking on another wide-reaching expense to household and corporate cash flows.

So try to temper your anger while watching the price go up at gas stations. Ignore much of the political spin that serves as energy policy analysis these days. And pray for Ukrainian peace — and the possible gas-price relief that may follow.

For your wallet’s sake, though, just look at track records: Rising gas prices, at a minimum, cool overall spending. Plan accordingly.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at [email protected]

Related Articles

Bill seeks profit transparency from California oil refiners

As gas prices surge, this delivery guy has a request: Please tip well

How sky-high gas prices are squeezing drivers across Southern California

Gas price increases ease but trouble simmers at Torrance refinery

Asian shares sink as war, inflation hold sway on markets