Soaring mortgage rates have iced California homebuying to a record low.

Look at what my trusty spreadsheet found when peeking at stats tracking August purchases and pricing for single-family existing homes from the California Association of Realtors. The Federal Reserve’s inflation battle – using high interest rates as the cooling agent – plus stubborn pricing is scaring off numerous house hunters.

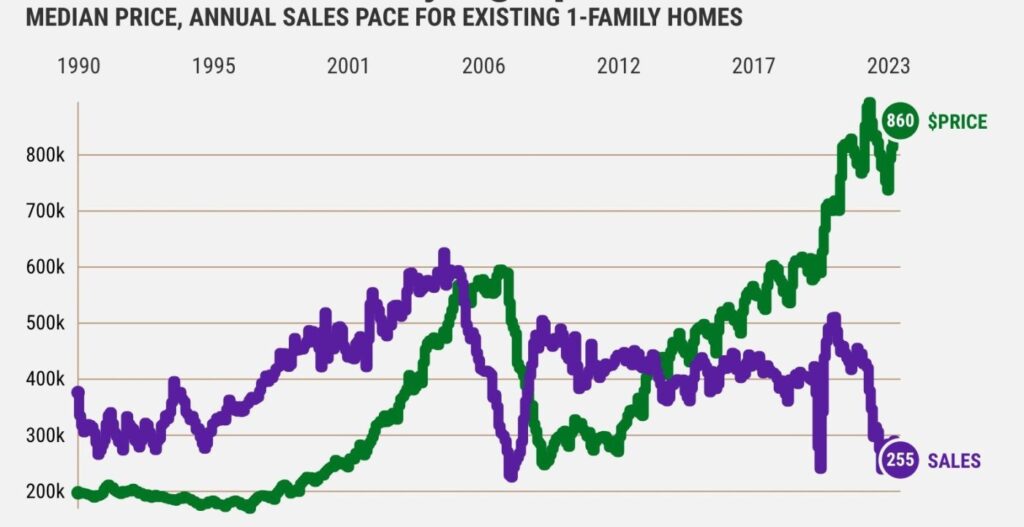

California houses were bought at an average 271,800-a-year pace during the 12 months ended in August. How listless has this lengthy slump been?

Sales are off 32% vs. the previous 12-month period.

It’s 38% below the 33-year average.

It’s the slowest 12 months of homebuying in a database that dates to January 1990.

This breaks the previous low set in the early days of the Great Recession in April 2008. Yes, THAT slow!

This past year’s sales drop hit every corner of the state with near conformity. Southern California buying is off 33% followed by the Bay Area, Central Valley and Central Coast, all off 30%, and the state’s northernmost counties, off 29%.

Now, some folks might point to August’s median sales price of $859,800, the third-highest on record, as a hint that the market’s still on firm footing. This value yardstick is up 3% in a month and up 3% in a year.

But is a record-high price a sign of resilience – or part of the problem? Let’s be honest: It’s a rare house hunter who can afford today’s pricing.

That small group, however, seems to be battling for a slim number of homes on the market.

WHAT EXODUS? California has 4th ‘stickiest’ population in US, says Dallas Fed

The Realtors estimate California’s supply of homes to buy is equal to 2.4 months of sales for August. That’s off 4% in a month and down 14% in a year – and 58% below the 33-year average.

Also, think about what this lofty pricing means for house hunter’s wallets when considering what mortgage rates have done.

The Realtor’s affordability index for the second quarter showed only 16% of California households could qualify to purchase the median-priced single-family home. And the homebuying challenge only got worse this summer.

Remember, the 30-year fixed-rate mortgage averaged 7.1% for August – up from 6.8% in July and 5.2% in 12 months earlier. And using August’s median price and assuming a California house hunter had a 20% downpayment and a loan at 7.1%, they got a $4,610 house payment.

That’s a cost up 6% in a month and up 25% in a year. Hey, it’s the largest payment on record.

By the way, since February 2020 – just before coronavirus upended the economy – this California estimate house payment has surged 122%. Something must give. Will it be prices? Rates? Or just years of limited homebuying.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at [email protected]

REAL ESTATE NEWSLETTER: Get our free ‘Home Stretch’ by email. SUBSCRIBE HERE!

Leaving California?

Which state ‘culture’ is your best alternative?

Where do ‘best state’ rankings tell you to move?

What states are the safest places to live?

Here are the healthiest states to consider

If you want ‘fun’ lifestyle, here are states to move to

States with the strongest job markets

What state is the best bargain?

Related Articles

As poverty rises nationally, California sees a small dip

Orange County housing voucher program opens wait list for first time in more than a decade

Real estate news: Placentia’s Union Place apartments sell for $63 million

Mayor Bass says 7,300 affordable housing units are in the development pipeline

Legislative fix would save student housing at Cerritos College, 18 other campuses