The saga of California’s inflation refund is coming to a close even as qualified taxpayers wait for their payments.

Gov. Gavin Newsom’s office said last fall that the state would distribute the one-time Middle-Class Tax Refund payments between late October and mid-January. The payments, which range from $200 to $1,050, are aimed at taxpayers who earn less than $500,000.

The good news: The Franchise Tax Board and its $25 million contractor, Money Network, have sent a combined 16,600,982 payments to recipients, either by direct deposit or debit card. While an early estimate from the state indicated the refund would reach 18 million recipients, the FTB now says the actual number is likely lower.

RELATED: Middle Class Tax Refund: Here’s another way to check your payment status

“It’s difficult to say how many more payments will ultimately be issued upon validation, but it’s clear that the ultimate total will be less than the 18 million originally estimated,” FTB media liaison Andrew LePage told us via email on Wednesday, Jan. 25.

So how many payments are still in the system? A call center employee at Money Network, the company managing the distribution of debit cards, said on Jan. 20 that as many as 1 million payments were still being “sent out” and the company had been given until the end of the month to finish the work.

That number prompted an email to the FTB for confirmation, even as more emails from confused and frazzled readers spilled into our MCTR inbox last week.

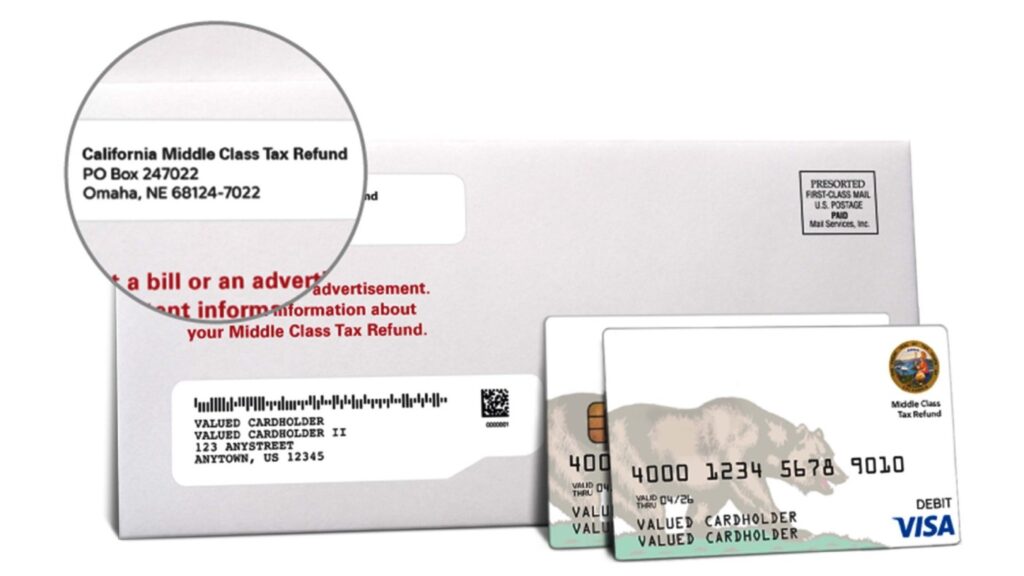

Millions of qualifying taxpayers are getting envelopes like this one sent home with a debit card loaded with California’s Middle Class Tax Refund. Recipients should read the attached instructions carefully to avoid transaction fees. (Samantha Gowen / SCNG)

We sent a bunch of questions to LePage. His answers have been edited for length.

Q: A Money Network representative told us Friday, Jan. 20 that the company has been given until the end of January to distribute more than 1 million MCTR debit cards. Is this true?

A: It is incorrect that we still have 1 million debit cards to issue or mail. As of mid-January, nearly all debit card payments had been mailed for those tax returns that have been identified as MCTR eligible.

READ MORE: MCTR questions: Can I get a paper check instead of a debit card?

Some of those payments are still in the mail and should be received by or around the end of this month.

We are seeing confusion between the use of the word mailed, distributed and issued and that may be the source of this issue.

Q: How many more payments are still in the pipeline?

A: A relatively small number of payments – those that are exceptions that fall into manual review to ensure eligibility – will be issued through Feb. 14 – the latest date we’ve identified for mailing cards to those who had recent address changes. In other, very unusual cases – again, exceptions in manual review – payments could be issued later than Feb. 14.

Once the cards are mailed, FTB is not able to track when the USPS delivers the card and our data is based on a mail date.

Toward the middle of next month, we hope to have a better idea – at least in a rough sense – of the ultimate total. (Again, a relatively small number of returns are still being processed to ensure eligibility.)

The Middle Class Tax Refund debit card must be cashed at certain in-network ATMs to avoid a transaction fee. (Courtesy of Money Network)

RELATED: How to cash California’s Middle Class Tax Refund debit card

Q: Is there a reason why the distribution didn’t finish by mid-January?

A: FTB has completed distribution of the cards as originally planned through the middle of January. It is also important to understand that the January 14th date was not a deadline. It was an expectation that has now been met. Over the next several months, as we continue handling exceptions or the re-issuance of cards, no deadline exists that would bar us from engaging in this critical work.

Q: Also, are there any more direct deposits heading to bank accounts? If so, how many?

A: Nearly all direct deposits have been issued. It’s possible there will be a relatively small number of additional direct deposits but it’s difficult to quantify given the aforementioned tax returns pending a manual review.

With tax filing season starting, several people emailed us after receiving an MCTR-related 1099-MISC in the mail.

Tina told us that while she declined the MCTR debit card and requested a paper check from the FTB, she has yet to get a payment. But the IRS form still came in the mail.

“Today we received a 1099 from the FTB for funds we did NOT receive for the tax year 2022,” she wrote. “I was not aware this was going to be taxable income. So we are now being taxed on income we did not receive. I wonder how many other taxpayers are in this same boat?”

LePage noted the MCTR payments will not be taxed by California but they “may be considered federal income.”

FTB, he said, is required to issue a 1099-MISC form for the taxable year the MCTR payment was made.

So what if you don’t actually receive the payment until 2023?

“Taxpayers or their tax preparers can refer to IRS Publication 525 (2022), Taxable and Nontaxable Income, to determine when the MCTR payment could be subject to tax in their situation.”

Related Articles

Would a wealth tax drive the rich out of California?

Blue states push for higher taxes on the rich

Status Update: Tax relief available for residents, businesses affected by winter storms

Trump’s company fined $1.6 million for tax fraud

Tax season begins Jan. 23 with IRS promising improvements

We will note that the IRS publication cited above is 43 pages long and tough to navigate, but an FAQ at the IRS website indicates only those who itemize need to include the refund. Here’s how that reads:

Whether or not your state income tax refund is taxable on your federal income tax return depends on whether you took an itemized deduction (Schedule A (Form 1040)) for the tax that was later refunded.

The IRS also notes:

— Don’t report any of the refund as income if you didn’t itemize your deductions on your federal tax return for the tax year that generated the refund.

— If you took an itemized deduction in an earlier year for taxes paid that were later refunded, you may have to include all or part of the refund as income on your tax return.

For anyone still struggling to determine their MCTR eligibility or status, be sure to call the Money Network and FTB early in the day and stay in the phone tree until you find a human who can answer your questions.

On a personal note, I called the Money Network number Jan. 20 to inquire about the payment I was expecting in mid-December, per the FTB’s schedule. The automated voice in the phone tree offered few specifics, only saying “call back after Jan. 31 if you haven’t received a payment.” Two days later, the MCTR debit card was in my mailbox.

How to check on your payment

Call the Money Network: 1-800-240-0223 (activate a card or check status) or 800-542-9332 for other questions.

Call the Franchise Tax Board: 1-800-852-5711

The state also has a “help” page on the FTB website where residents can check eligibility and how much they’ll receive.

If all else fails, contact your California representative and have them escalate your case. They surely have good contacts in Sacramento.

Readers, keep me posted on your MCTR progress or lack thereof at [email protected]