”Survey says” looks at various rankings and scorecards judging geographic locations while noting these grades are best seen as a mix of artful interpretation and data.

Buzz: Typical Southern California first-time homebuyers need to make an extra $54,000 — or 94% — compared to other Americans seeking a starter home.

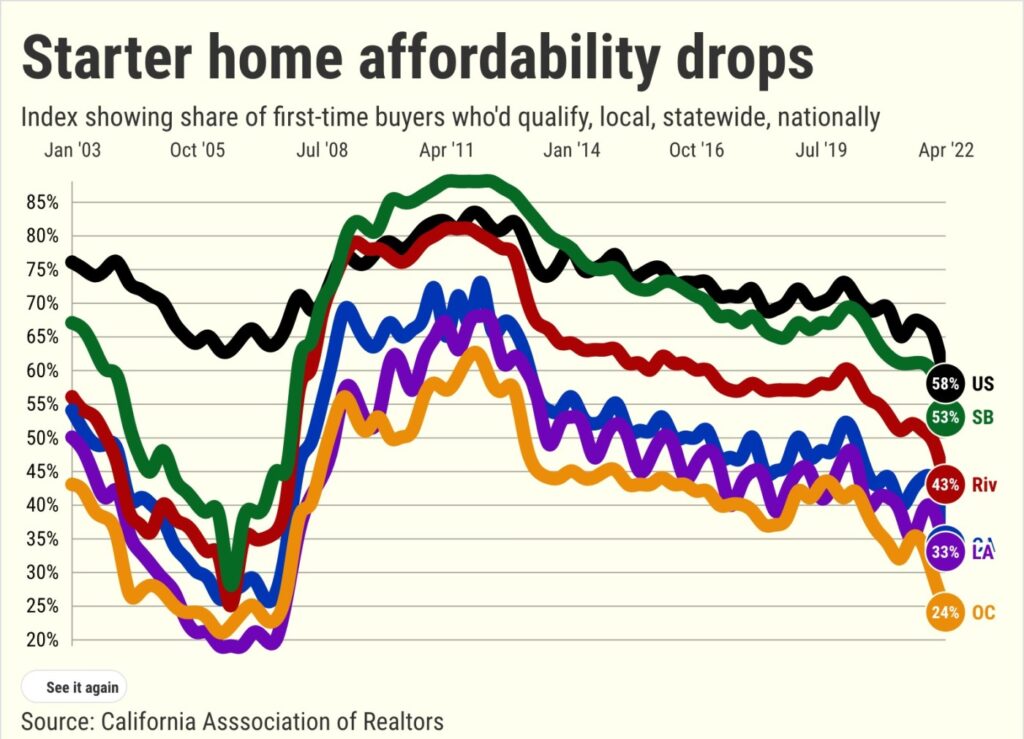

Source: My trusty spreadsheet’s look at the California Association of Realtors’ first-time buyer “affordability” index for the spring quarter. This yardstick provides a noteworthy window into how financial headaches compare within this important slice of the housing market.

This index estimates what a starter home cost by tallying the required monthly payments on a residence priced at 85% of the median existing single-family home. This purchase would be financed with a 10% downpayment on an adjustable rate mortgage — with property taxes and insurance included.

And “affordable” means in this math that the monthly ownership costs no more than 40% of local household incomes.

Topline

The hypothetical first-time buyer in Southern California needs at least $111,600 of income to qualify for the $3,720 monthly payment required for a $680,000 residence. And this math says just 36% of the region’s households could qualify to buy a starter home in spring 2022 — way down from 43% a year earlier.

Remember, as of June, Southern California homes were appreciating at an 8.5% annual rate, by Realtor math. And the average adjustable-loan rates had risen to 4.3% from 2.6%, according to Freddie Mac.

Where are California’s weakest housing markets?

Want to know why so few Americans move to California?

A similar first-time house hunter across the nation needs only a $57,600 income to qualify for a $1,920 payment on $351,480 residence. That’s why U.S. affordability ran 58% this spring — but that, too, was down from 65% a year earlier.

It’s not just Southern California: Statewide, the same novice house hunter needs $123,300 income — $4,110 payment on $750,860 residence. Affordability? 34% spring 2022 vs. 40% a year earlier.

This adds up to a Southern Californian searching for a starter home needing $54,000 more income — 94% — than a typical American. Though, it’s a California “bargain” — requiring $11,700 or 9% less income that the statewide norm.

Local details

How the starter home’s affordability challenge plays out across the region, by county …

Los Angeles: $115,200 income required to make a $3,840 payment for a $701,800 residence. That’s 7% less pay vs. California but it’s $57,600 or 100% above the U.S. Affordability was 33% of households in spring 2022 vs. 39% a year earlier.

Orange: $181,500 required — $6,050 payment on $1.1 million residence — 47% more pay vs. California and $123,900 or 215% above the U.S. Affordability? 24% spring 2022 vs. 32% a year earlier.

Riverside: $89,400 required — $2,980 payment on $544,000 residence — 27% less pay vs. California and $31,800 or 55% above the U.S. Affordability? 43% spring 2022 vs. 51% a year earlier.

San Bernardino: $68,700 required — $2,290 payment on $419,050 residence — 44% less pay vs. California and $11,100 or 19% above the U.S. Affordability? 53% spring 2022 vs. 61% a year earlier.

San Diego: $134,700 required — $4,490 payment on $820,990 residence — 9% more pay vs. California and $77,100 or 134% above the U.S. Affordability? 31% spring 2022 vs. 39% a year earlier.

Ventura: $131,100 required — $4,370 payment on $798,150 residence — 6% more pay vs. California and $73,500 or 128% above the U.S. Affordability? 34% spring 2022 vs. 42% a year earlier.

Bottom line

Call this income gap the price of paradise — or the financially taxing result of various troublesome housing policies. And first-timers must also compete with investors, who’ll often pay up to grab another income-producing property.

I can offer one bit of solace to a first-time Southern California house hunter. You could be looking in the Bay Area.

That’s where a buyer needs a $208,800 income for the $6,960 payment on $1.27 million residence. That’s $85,500 or 87% more pay vs. Southern California and $151,200 or 263% above the U.S. Affordability? Only 28% in the spring vs. 34% a year earlier.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com