“Bubble Watch” digs into trends that may indicate economic and/or housing market troubles ahead.

Buzz: California consumers’ concern about their economic future has hit its Biden-era low.

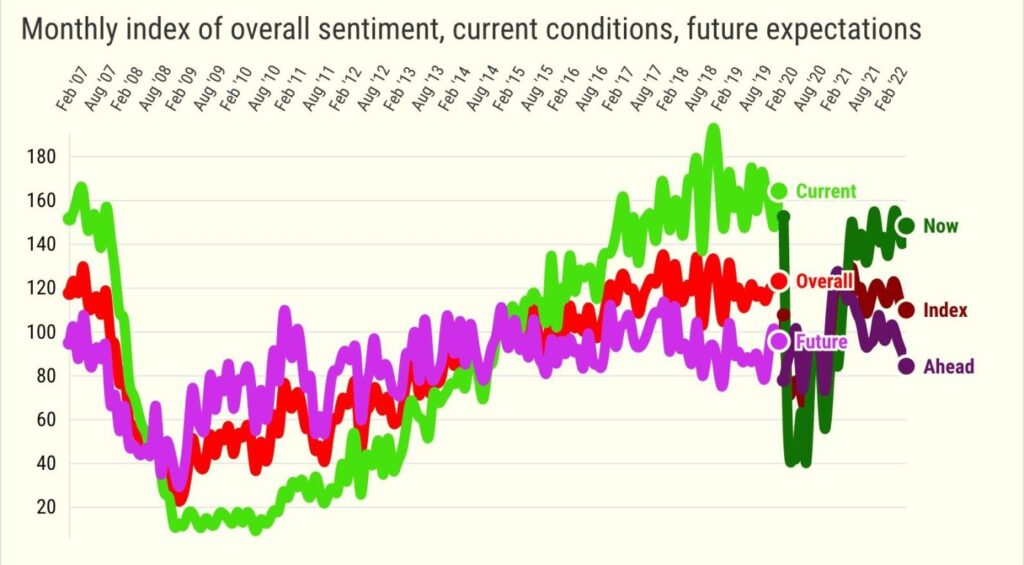

Source: The Conference Board’s monthly polling of shoppers for June creates various consumer confidence indexes, including one for California.

The Trend

With inflation running at four-decade highs and the Federal Reserve all but threatening a recession to cool an overheated cost of living, is a sour economic outlook such a shock?

In California, this expectations index was 84.1 for June — the lowest since Joe Biden became president in January 2021. It’s also down from 90.8 the previous month and down from 115.5 a year earlier. This measure averaged 94 in 2015-19.

California is no outlier. Among the seven other states tracked by this consumer confidence research, June expectations were the lowest of the Biden presidency in Texas, Pennsylvania, Michigan — and nationwide. It was second-worst in Florida, Illinois and Ohio, and No. 4 in New York.

California’s overall statewide index was 109.7 in June, down from a revised 110.5 a month earlier and down from 129.3 a year ago. California confidence averaged 113 in the five years before the pandemic.

Curiously, California consumers’ views of current conditions improved, with this index at 148.1 for the month — up from 140 a month earlier and below 150 a year earlier. This measure averaged 141 in 2015-19.

My guess is that these economic options reflect a hot jobs market with low unemployment, plenty of opportunities and large raises.

Elsewhere

In the other states …

Overall confidence: Three increases among the seven states in a month and none up over the year. Nationally? Down for the month and 12 months.

Current conditions: Five increases in a month and one up over the year. Nationally? Down for the month and 12 months.

Big picture

What’s driving swings in optimism? The Conference Board also asks consumers nationwide about the job market and plans to make major purchases in the next six months …

More jobs? U.S. shoppers think bosses may cool the hiring pace as 16.3% expect more employment — down from 17.5% a month earlier and down from 26.6% a year earlier.

Buy a home? A historic jump in mortgage rates left just 5.6% of those surveyed in a house-hunting mood — unchanged vs. the previous month but down from 6.8% 12 months ago. This also may push builders to slow their construction pace.

Buy a vehicle? Folks still need to get places so 10.4% of us will be car shopping — up from 9.8% a month earlier but down from 11.5% a year earlier.

Related Articles

Stocks rally, driving Wall Street to a rare winning week

Wall Street shakes off a midday stumble and ends higher

Why the Fed is risking a recession

Orange County home prices could fall 14%, says Chapman forecast

Powell: Fed aims to avoid recession, and says it’s possible

“

Major appliance purchase? If the fridge dies, you buy a new one. So 46% of folks are looking — up from 44% the previous month but down from 50% 12 months ago.

Then there’s the giant unnerving trend, inflation.

Americans polled expect the cost of living to be 7.7% higher in a year, up from 6.8% a month earlier and up from 5.7% a year earlier.

As for the stock market, 44% of Americans polled see it lower in 12 months, the same as the previous month and up from 31% 12 months ago. Wall Street’s bear market iced expectations.

How bubbly?

On a scale of zero bubbles (no bubble here) to five bubbles (five-alarm warning) … FIVE BUBBLES!

Let’s remember it’s hard for the risk-taking California economy to move forward with shoppers worried about the future. And when consumers get truly cautious, those fears can turn an economic cooling into a deep freeze.

Plus, note the political implications of monetarily antsy voters with midterm elections on the horizon is not a good backdrop for Biden and his fellow Democrats.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at [email protected]