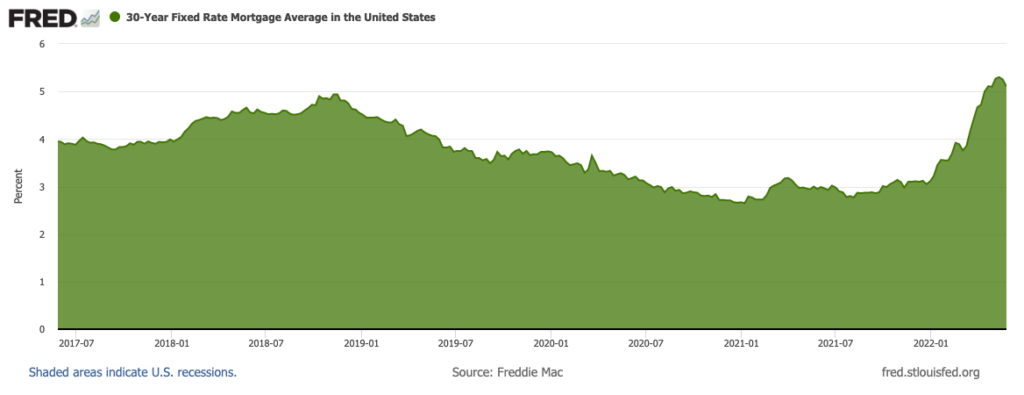

Mortgage rates dipped slightly for the third straight week of declines.

The average for a 30-year loan was 5.09%, down slightly from 5.1% last week, Freddie Mac said in a statement Thursday.

Buyers have gotten a slight reprieve in recent weeks from the massive run-up in mortgage rates that’s dominated this year. Borrowing costs are still up nearly 2 percentage points from the end of 2021, an increase that’s started to have a cooling effect on the housing market. Nearly one in five sellers cut listing prices in the four weeks ended May 22, the highest level since October 2019, Redfin Corp. said last week in a report.

“Mortgage rates continued to inch downward this week but are still significantly higher than last year, affecting affordability and purchase demand,” Sam Khater, Freddie Mac’s chief economist, said in the statement. “Heading into the summer, the potential homebuyer pool has shrunk, supply is on the rise and the housing market is normalizing. This is welcome news following unprecedented market tightness over the last couple years.”

Consumers have had to contend with an increasingly difficult affordability situation in recent years as prices soared during the pandemic. The S&P CoreLogic Case-Shiller Index showed earlier this week showed price gains continued to accelerate in the year through March.

At the current 30-year average, a borrower with a $300,000 mortgage would pay $1,627 a month, $344 more than at the end of last year.

Rising prices had already been pushing many prospective buyers to the sidelines. But as rates continued to rise this year, even more home shoppers have put their search on hold.

Related Articles

Which president did the best job with inflation?

Unique loan offers no income threshold for underserved homebuyers

Biggest jump ever: Southern California house payments up 37%, topping $3,000 a month

US housing starts, building permits stall as mortgage rates bite

House hunters triple use of adjustable-rate mortgages

“The relentless rise in home prices and recent increase in interest rates slowed down buyer activity in April as shown by a month-over-month drop in existing home sales, new home sales, and pending home sales, as some buyers opted out of the market altogether,” said Hannah Jones, economic data analyst at Realtor.com. “Still, home buyers continued to contend with record-high home prices in May.”

But, she said, there may be good news ahead with more homes coming onto the market.

“While inventory is still low by historical standards, it is starting to tilt in a more buyer-friendly direction,” said Jones. “This is likely to lead to slower price growth in the not-so-distant future as sellers compete for buyers, finally creating a more balanced market.”

Still, many buyers can’t afford to buy a home that fits their needs with interest rates so high.

“Those who are currently home shopping will tell you that we’re not there yet, as still-high interest rates and home prices are creating challenges in finding their ideal home,” said Jones.

<em>Bloomberg News and CNN contributed to this report.</em>