”Survey says” looks at various rankings and scorecards judging geographic locations while noting these grades are best seen as a mix of artful interpretation and data.

Buzz: If you want a quasi-affordable California home, look far from the coast and the big cities.

Source: My trusty spreadsheet reviewed third-quarter homebuying affordability stats for 578 big US counties – including 35 California counties, compiled by ATTOM, a real estate data provider.

Topline

First, we ranked the counties on pricing, purchasing power and historical affordability. Then we combined those scorecards.

And, drumroll please … Butte is California’s bargain county. It’s far to the north and home to Chico and the Oroville Dam.

The next county for affordability was Imperial, followed by Humboldt, Tulare and Fresno.

The least affordable county, by this math, was Santa Cruz, Monterey, Orange, San Diego and Alameda.

Details

Let’s get inside those county rankings, noting that there’s plenty of “art” involved in homebuying affordability math.

Pricing: What does it cost?

Tulare County house hunters have it best, in California terms, with a $338,000 median home price that requires an annual income of $83,000 to qualify for a loan with 20% down at prevailing rates and a 28% debt-to-income ratio.

Next was Kern’s $340,000 median, which requires an $86,000 annual income, followed by Imperial’s $355,000 ($87,000 income), Kings’s $359,000 ($89,000), and Butte’s $385,000 ($95,000).

ECONOMIC NEWS: What’s the big trend? Should I be worried? CLICK HERE!

The costliest: Santa Clara County’s $ 1.48 million median requires a $358,000 annual income. San Mateo’s $ 1.47 million requires $356,500 while Marin’s $1.3 million requires $325,500. In San Francisco, the median $1.29 million home requires $319,500 in income, and Santa Cruz’s $1.17 million requires $283,500.

Contrast that to the typical American buyer who paid $319,950 for a home that required $88,000 in pay.

Purchasing power: The gap between estimated payments and wages.

Kern County buyers are in the best shape. The typical mortgage payment, $2,008 a month, would eat up just 43% of the $4,681 average local wage. Next was Sacramento at 46%, then Tulare, Imperial and Kings counties at 47%.

At the other end of the affordability spectrum, there’s Santa Cruz County. Mortgage payments of $6,614 equals 123% of the $5,390 local wage. That the widest spread in the nation among the 578 US counties tracked by ATTOM

Next lowest by this California affordability yardstick was Monterey at 101% – ranking third-highest nationally. Marin at 100% (No. 4), Orange at 95% (No. 6), and San Luis Obispo at 94% (No. 7).

Yes, homes in these counties create payments that would gobble up a worker’s entire paychecks. That why two incomes – and we’re talking good salaries, too – are a minimum need to be homebuyers in these communities.

Note that the typical nationwide house payment of $2,053 claimed 39% of what a common US worker makes – $5,935.

Historical affordability: How today compares with norms dating to 2005.

San Francisco County is the only one of the 35 California counties with affordability above its 18-year average.

REAL ESTATE NEWSLETTER: Get our free ‘Home Stretch’ by email. SUBSCRIBE HERE!

An 8% improvement largely reflects San Francisco’s cascading home values, which are down 15% from their recent peak. Only one of the 578 US counties had a bigger improvement – Illinois’ tiny Macon County.

Next in California was San Mateo, with affordability 8% below average. Marin was 15% below, Humboldt at 17% below, and Butte at 18% below.

Affordability in Monterey and San Bernardino counties look historically the worst at 33% below their norms. Then comes Riverside and Kern at 32% below.

Nationally, affordability’s hurting, too, off 31% from the US average.

Bottom line

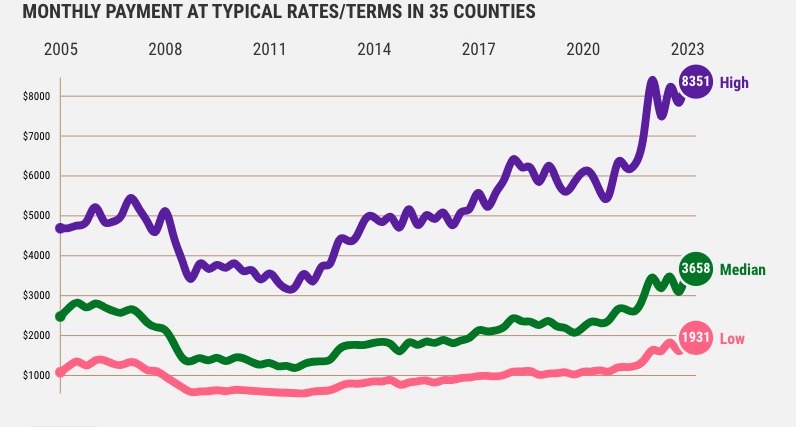

Look what the pandemic era did to California house hunters as both prices and mortgage rates soared.

The median house payment in the 35 counties was $3,658 in the third quarter. That’s up 68% since the end of 2019 – when few knew what coronavirus was.

California’s highest payment among the counties was $8,351 (Santa Clara) – up 49% since 2019. But the low payment of $1,931 (Tulare) reflects an 81% increase.

So California “bargains” are getting far pricier.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at [email protected]

Leaving California?

Which state ‘culture’ is your best alternative?

Where do ‘best state’ rankings tell you to move?

What states are the safest places to live?

Here are the healthiest states to consider

If you want ‘fun’ lifestyle, here are states to move to

States with the strongest job markets

What state is the best bargain?

Related Articles

These 8th graders are building a tiny home to help out a student and their family

Santa Ana City Council moves to protect city’s rent control and eviction ordinances

How can Los Angeles bring more Black men into teaching? Build them a village

Century 21 CEO: Housing shortage will persist

Loophole lets developers put big apartment buildings next to SF Valley houses