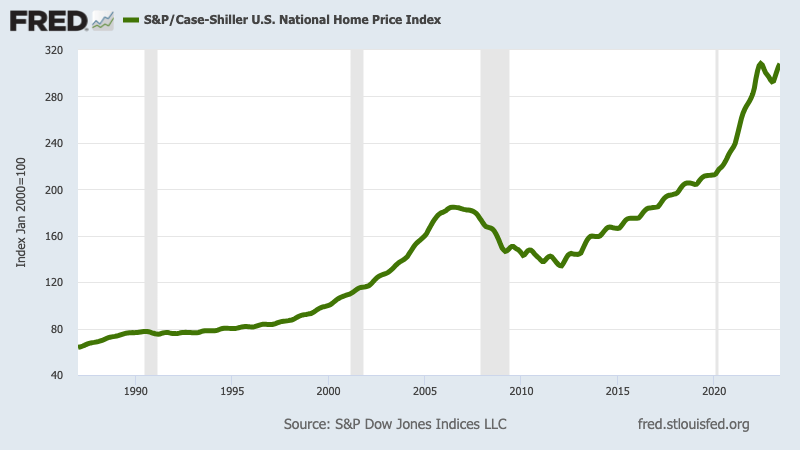

An index for U.S. home prices rose in June, bringing it just below its all-time high notched a year ago, but the strength isn’t universal.

The S&P CoreLogic Case-Shiller US National Home Price Index rose 0.9% from the month before, according to data released Tuesday.

A home-price roller coaster of the past year left the national benchmark was essentially flat, year over year. It’s also a smidge below its all-time high set in June 2022. And it’s up 43% since February 2020, the month before coronavirus upended real estate and the overall economy.

But it’s a split nation. Look at the 20 metros tracked by this index.

Prices are down in 10 markets vs. a year ago and they’re off from all-time highs set in the binge-buying days fueled by cheap mortgages used to revive a coronavirus-chilled economy …

San Francisco: Off 9.7% in a year, off 10.9% from recent peak pricing, but up 30% in the pandemic era.

Seattle: Off 8.8% in a year, off 10.5% from peak, up 43% in pandemic era.

Las Vegas: Off 8.2% in a year, off 8.3% from peak, up 40% in pandemic era.

Phoenix: Off 7.5% in a year, off 7.5% from peak, up 58% in pandemic era.

Denver: Off 4.4% in a year, off 4.5% from peak, up 41% in pandemic era.

Portland: Off 4.2% in a year, off 4.3% from peak, up 35% in pandemic era.

Dallas: Off 4.1% in a year, off 4.1% from peak, up 53% in pandemic era.

San Diego: Off 2.5% in a year, off 3.2% from peak, up 56% in pandemic era.

Los Angeles/Orange counties: Off 1.8% in a year, off 2.3% from peak, up 42% in pandemic era.

Tampa: Off 0.9% in a year, off 1.5% from peak, up 66% in pandemic era.

And new all-time highs were set in July in 10 markets …

Washington: Up 0.6% in a year and up 32% in pandemic era.

Minneapolis: Up 0.7% in a year and up 32% in pandemic era.

Boston: Up 0.9% in a year and up 42% in pandemic era.

Charlotte: Up 1.7% in a year and up 58% in pandemic era.

Atlanta: Up 2.1% in a year and up 52% in pandemic era.

Detroit: Up 2.2% in a year and up 39% in pandemic era.

Miami: Up 2.5% in a year and up 67% in pandemic era.

New York: Up 3.4% in a year and up 40% in pandemic era.

Cleveland: Up 4.1% in a year and up 43% in pandemic era.

Chicago: Up 4.2% in a year and up 37% in pandemic era.

Stubbornly high mortgage rates complicate the situation for potential homebuyers, said Selma Hepp, CoreLogic’s chief economist. That will likely keep price gains in check during the rest of the year, she added.

Home prices are expected to reaccelerate and reach a mid-single-digit growth rate by the end of the year, she said.

“Home price acceleration is most notable in markets that remained relatively affordable throughout the pandemic and saw less volatility from household migration, such as those in the Midwest and New England,” said Hepp. “Home prices in these markets are now catching up with more expensive ones.”

The report showed the power of historically low inventory on home prices, which maintained strength despite ongoing affordability challenges, said Hannah Jones, economic data analyst at Realtor.com.

Low inventory is pushing prices higher because so few homeowners want to sell their home and give up their ultra-low mortgage rate of 3% or 4% to buy another home at 6% or 7%. The report tracks housing data from April, May and June. During that period, average rates for a 30-year, fixed-rate mortgage reached as high as 6.79%, according to Freddie Mac.

“Many existing homeowners remain on the sidelines of the market, content to stay put as mortgage rates reach 20-year highs,” said Jones. “As a result, home shoppers are seeing fewer existing homes for sale and facing more competition for the homes available.”

Builders have started to pick up construction activity to fill this gap, she said, but remain cautious as affordability challenges continue to stifle buyer demand.

“Limited home inventory, still-high prices and elevated mortgage rates meant that both new and existing home sales fell in June, though new home sales remained well above the previous year’s level,” said Jones.

The rental market could offer would-be buyers an affordable option as they save up for a home purchase. At a national level, rents have fallen annually for the last three months as increased rental inventory relieved some price pressure, according to Realtor.com.

REAL ESTATE NEWSLETTER: Get our free ‘Home Stretch’ by email. SUBSCRIBE HERE!

CNN and Jonathan Lansner, business columnist for the Southern California News Group, contributed to this report.

Leaving California?

Which state ‘culture’ is your best alternative?

What states are the safest places to live?

Here are the healthiest states to consider

If you want ‘fun’ lifestyle, here are states to move to

States with the strongest job markets

What state is the best bargain?

Related Articles

Southern California home prices near record high despite sales plunge

This Bay Area city makes list of hottest ZIP codes in U.S. for home buyers — but Bakersfield has it beat

California house hunters face record $4,359 monthly payment

Home prices dip in 35 Orange County ZIPs. How did your neighborhood fare?

Orange County home prices hit record high, Los Angeles remains 3% below its peak