Soaring mortgage rates and stubbornly high prices pushed homebuying in Los Angeles and Orange counties to the slowest-selling July on record.

Purchases of houses and condos, existing and new, totaled 6,496 in July in the two counties, according to CoreLogic. That’s down 14% for the month and down 18% for the year. How slow is that?

It was the slowest-selling July in records dating to 1988.

It was the 19th-smallest sales total for any month over 35 years.

Only 4% of all months have been slower.

It was 46% below the average July sales pace since 1988.

In the past 12 months, the 105,770 sales ran 38% below average.

No 12-month period had fewer sales.

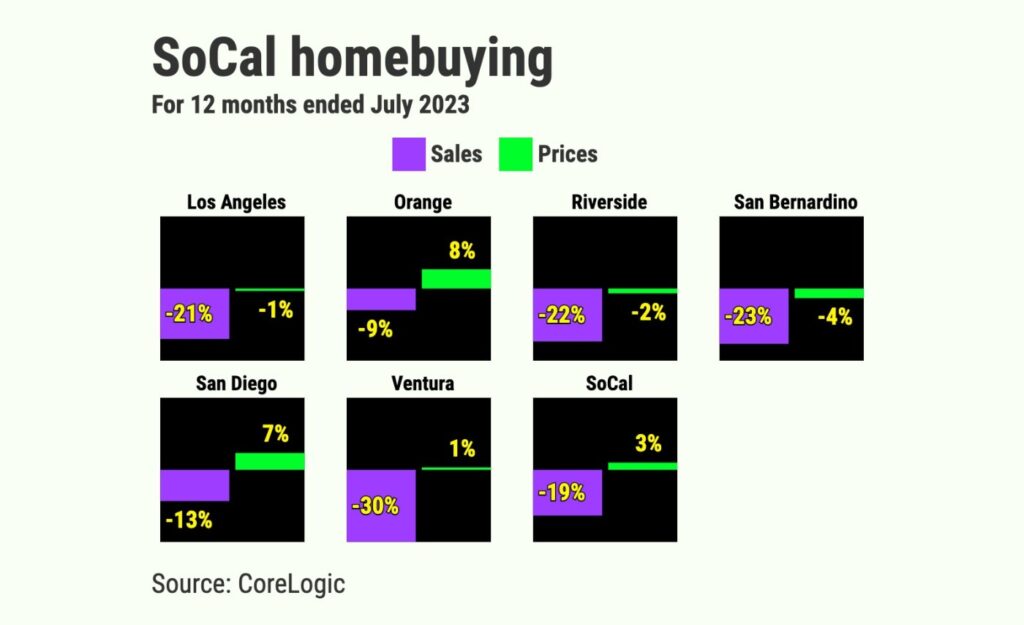

This year has seen house hunting drastically pull back. Lofty rates cut buying power by 14%. Limited buying options also hindered sales. So, across the six-county Southern California region, sales fell 19% in a year to 13,998.

Affordability was also hurt by pricing. The six-county region’s median sales price increased 2.5% to $743,000 – 1% off the $750,000 record set in April 2022.

The basics

Let’s look inside the LA-OC market, starting with July’s sales.

LA had 4,418 closings, down 16% in a month and 21% lower in a year. OC had 2,078 sales, down 10% in a month and 9% lower in a year.

Next, consider how prices moved.

LA’s $830,000 median was flat for the month and 1% lower in a year. That’s also 3% off the $860,000 record set in April 2022.

OC’s $1.075 million median was up 1.5% in a month and 8% higher in a year. This tops the previous $1.059 million high set in June 2023.

Payment pain

Pricier financing was a factor as the 30-year mortgage averaged 6.84% in July vs. 5.41% 12 months earlier.

Here’s how that hit homebuying costs, by county …

My trusty spreadsheet tells me LA buyers got an estimated house payment that’s 16% pricier – $4,346 per month on the $830,000 median vs. $3,755 on a year ago’s $835,000 home. And that’s assumes having $166,000 for a 20% downpayment.

OC buyers got a 25% bigger payment – $5,629 monthly on the $1.075 million median vs. $4,497 on a year ago’s $1 million home. The OC downpayment was $215,000 or 20%.

Single-family homes

Sales: LA’s 3,185 transactions were down 16% in a month and 18% lower in a year. OC’s 1,326 closings were down 11% in a month and 8% lower in a year.

Prices: LA’s $899,000 median was flat in a month and 1% higher in a year. OC’s $1.24 million median was up 3% in a month and 9% higher in a year.

Condos

Sales: LA 1,051 sold — down 16% in a month and 24% lower in a year. OC’s 618 sales were down 2% in a month and 4% lower in a year.

Prices: LA’s $685,000 median was flat for the month and the year. OC’s $762,500 median was up 2% in a month and 8% higher in a year.

New homes

Sales: LA builders sold 98 units — down 36% in a month and 63% lower in a year. OC had 133 new residences sold — down 23% in a month and 27% lower in a year.

Prices: LA’s $837,500 new-home median was down 8% in a month and 9% lower in a year. OC’s $1.25 million median was up 8% in a month and 21% lower in a year.

Related Articles

La Habra wins court fight with nation’s No. 2 homebuilder

Inland Empire homebuying drops 22% in a year

John Lautner-designed home in Long Beach seeks $3.4M a year after selling

10 California metros among 20 costliest places to raise a child

US home prices a very split picture, Case-Shiller index shows

Builder share: In LA, 2.2% of all closings last month were newly built residences compared to 4.8% 12 months earlier. OC builder had 6.4% share of the month’s closings vs. 8% 12 months earlier.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com