A big yellow envelope has been showing up in the mailboxes of Southern Californians who get their health insurance through Medi-Cal, and if it’s been ignored, those who needed to have their eligibility reviewed starting July 1 are at-risk of losing their coverage.

During the coronavirus pandemic, the annual process of having eligibility “redetermined” for Medi-Cal, California’s Medicaid health insurance program for providing free or low-cost coverage for those with limited incomes, was put on hold. People were automatically renewed each year without having to show they still met eligibility requirements.

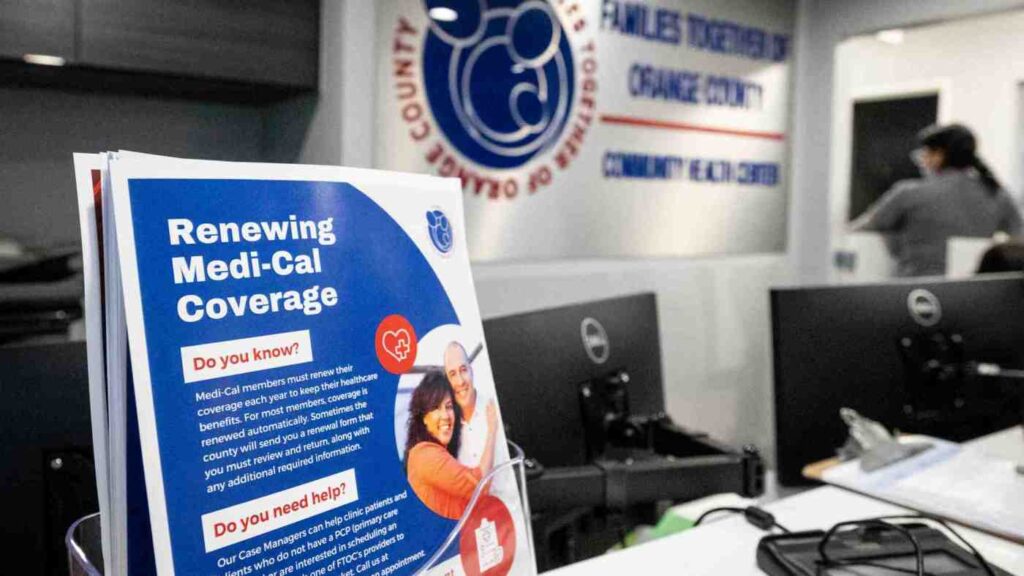

Nationally, 25 states ahead of California have already started the redetermination process and culling people from their Medicaid programs. An estimated more than 1.5 million people have lost coverage so far, and local health officials worry that many of them were due to procedural reasons that could have been avoided. Now, the review process is back in effect in California starting July 1, and community health centers, health care agencies and providers have been scrambling to ensure their patients are aware of the process they’ll need to go through when their renewal window comes up.

Experts with L.A. Care Health Plan and Orange County’s CalOptima Health estimated 2.7 million people in Los Angeles and 985,000 people in Orange County could be dropped if they miss their window to re-enroll. An estimated 300,000 Inland Empire residents were estimated at risk of losing their Medi-Cal benefits when the Inland Empire Health Plan launched a redetermination campaign earlier this year.

“It feels like we’ve been getting ready for this moment for the last three years since the pandemic started, and the continuous coverage provision was put into place,” Phinney Ahn, director of Medi-Cal for L.A. Care Health Plan said. “Which by the way, we think was actually a really great thing during a pandemic: To make sure that people did not experience any disruptions in their coverage so that they can access care if and when they needed it during a pandemic.”

Ahn said L.A. Care started preparing members 18 months ago for when the continuous coverage provision would end. She said its leadership wanted to raise awareness and not have members panic, instead letting them know way in advance that Medi-Cal members would have to take proactive action to keep their coverage.

“The packet could seem long and cumbersome and confusing,” she said of the paperwork mailed out to each member. “I’ve also recently heard, unfortunately, there are scams out there. People are asking for money to help people renew their Medi-Cal and there’s absolutely no cost to renewing your Medi-Cal.”

To let Medi-Cal beneficiaries know about the renewal process, L.A. Care has taken to social media; called, texted and mailed members the information; mobilized their health promoters and got the information into their community resource centers as well.

The Inland Empire Health Plan, Riverside County’s Department of Public Social Services and San Bernardino County’s Transitional Assistance Department have been working in tandem since April “to share data and coordinate strategic outreach efforts to ensure residents undergoing the Medi-Cal renewal process complete and submit requested information,” officials said when announcing the partnership.

Riverside County officials have connected with local hospitals, clinics and health care providers to reach Medi-Cal members whose coverage could expire.

A common theme of why people aren’t completing their renewal packets, officials said, is they might have moved recently and not updated their address or the packet was too confusing or they thought it was a scam.

Kimberly Graham, director of patient access at AltaMed Health Services, said members mistrusting correspondence is “so common.”

AltaMed serves more than 400,000 people in Los Angeles and Orange counties. Graham said team members who were doing community outreach heard firsthand how members were ignoring renewal notices in fear that it was from scammers who wanted to steal their identity.

“We’ve actually started to kind of re-navigate our efforts to focus on events that are by trusted sources,” Graham said, adding that the health services provider is also utilizing its call center to further reach members. “We’ve sent text messages on behalf of AltaMed, not necessarily focused on the details of re-determination, but saying, ‘Hey, call this number for help.’”

Michael Hunn, CEO at CalOptima Health, said of the 46,000 renewal notices due in July that were sent to Medi-Cal members in Orange County, about 10,600 have not been returned to the Orange County Social Services Agency as of Tuesday.

“Our concern is folks don’t know that they need to fill those out and send them back,” Hunn said, adding that CalOptima’s customer service representatives will be making about 70,000 calls per month to members to ensure they know about the renewal process. “We’re actively reaching out to folks and asking, ‘Is there a reason you’re not returning it?’ ‘Do you still need Medi-Cal?’”

If a Medi-Cal member does miss their renewal date, they have 90 days to fill out their application and reinstate their coverage. If they fail to do so, they are going to need to start their application over again, a lengthy process. Either way they will have a gap in their coverage.

“This is a very challenging process, but we are working hand in hand with our social service agency,” Hunn said. “It is not going to be perfect, but we are working our hearts out to make sure that we show as much dignity and respect as we possibly can to our members. The last thing we want is for somebody to lose their health insurance coverage when they’re entitled to it.”

There will be a lot of people who legitimately are no longer eligible for Medi-Cal, either because they make too much money now or they got a job, officials said.

“If they’re no longer eligible for Medi-Cal, that they can find other coverage options that meet their needs,” Ahn said. “We always encourage people to go to Cover California to see what other coverage options are available to them and we’re always promoting LA Care Covered as a really good option, especially for our former Medi-Cal beneficiaries so that they can have continuity of plan.”