Southern California home prices fell for a sixth-straight month in November, wiping out most of the price gains achieved during the first half of the year.

The median price of a Southern California home – or the price at the midpoint of all sales — dropped to $690,000 in November, up a mere $10,000 from year-ago prices, according to new numbers from real estate data firm CoreLogic released Wednesday. Last month’s median price was down $70,000, or 9%, from the all-time high of $760,000 reached in April and May.

Related: U.S. home prices slip for 4th month, California metros have 3 of the biggest drops

While home prices increased on an annual basis, last month’s 1.5% year-over-year gain was the smallest in three years. By comparison, annual gains in the region averaged 11% for the past two years.

Southern California home sales, meanwhile, fell to 13,016 transactions in November, CoreLogic reported. That’s the smallest sales tally for a November, and 13th smallest for any month, in 35 years. It was the 12th straight month of year-over-year sales drops, with 44% fewer transactions than in November 2021.

“It’s shifting. People are shifting their mindsets,” said Darin Eppich, an agent with Sotheby’s International Realty in Beverly Hills. “A lot of it is (interest) rates, and a lot of it is the monthly (mortgage payment). So, those buyers are waiting ’til the New Year.”

No outlier

Southern California’s trends match what’s happening across the state and nation.

The state Realtor association reported that sales of existing houses fell 47.7 percent from November 2021in California and the National Association of Realtors reported a 35.4% sales drop nationwide from the previous year.

And the Case-Shiller indexes for October showed San Diego prices off 8.5% vs. their spring peak and Los Angeles-Orange County off 6.6%.

“In essence, the residential real estate market was frozen in November, resembling the sales activity seen during the COVID-19 economic lockdowns in 2020,” said NAR Chief Economist Lawrence Yun.

The principal factor, Yun said, was the rapid increase in mortgage rates, which hurt housing affordability. Rates more than doubled in 2022, causing November’s monthly house payment for a median-priced Southern California home to jump $1,247 from the year before. That’s a 53% increase in the “monthly nut.”

Rate shock turned the 2020-21 buying frenzy into a freeze, sending buyers and sellers alike into their separate corners to wait out the slowdown.

“The short and sweet takeaway right here,” said Boyd Roberts, broker-owner of Laguna Gallery Real Estate, “ … (is) there’s almost no buyers out there.”

How slow?

Homes are taking longer to sell, causing the number listings to swell and forcing sellers to cut their prices.

Redfin’s November housing figures show how dramatically the local market changed since last spring, when 30-year rates averaged 4.5%. Southern California homes averaged about 6.5 weeks on the market last month before finding a buyer, up from around three weeks in March and April. As a result, the inventory of homes for sale increased 42% since March to just under 34,000 homes.

With so many homes to choose from, prices are averaging 1.5% below the sellers’ asking price, compared with 4.5% above asking last spring, Redfin figures show.

Some homeowners haven’t gotten the memo that it’s no longer “a full seller’s market like the last year and a half,” said Eppich, the Beverly Hills agent.

“Earlier in the year, a property could be in escrow in a week,” he said. “Now, you see a property sit 60 days. Some I’ve seen sit for 100 days.”

Buyers who purchased at the peak of the market last spring likely experienced some paper losses in their home’s value. Some may even be “underwater,” meaning the amount they owe on their mortgage is greater than their home’s current value.

As of October, just over 26,000 Southern California homes were underwater, compared with fewer than 7,000 at the end of last year, Black Knight figures show.

That’s fewer than 1% of all homes with a mortgage and far from catastrophic. During the foreclosure crisis of 2009-12, as many as 24% of U.S. homes were underwater..

Related Articles

U.S. home prices slip for 4th month, California metros have 3 of the biggest drops

California had both No. 1 home-price drop – and No. 1 increase – among U.S. metro areas

New home sales also played a key role in the November housing market.

CoreLogic reported 1,955 new homes (which tend to cost more) sold last month, accounting for 15% of all homes sold in November. That’s the biggest new-home share since March 2008.

The reason, said Irvine-based real estate consultant John Burns, is builders are giving buyers better deals. Builders have been heavily discounting their sale prices and helping buyers “pay down” their mortgage rates since June, he said.

“You’re getting a much better deal on a new home than in June, and resale homes haven’t corrected as much,” Burns said.

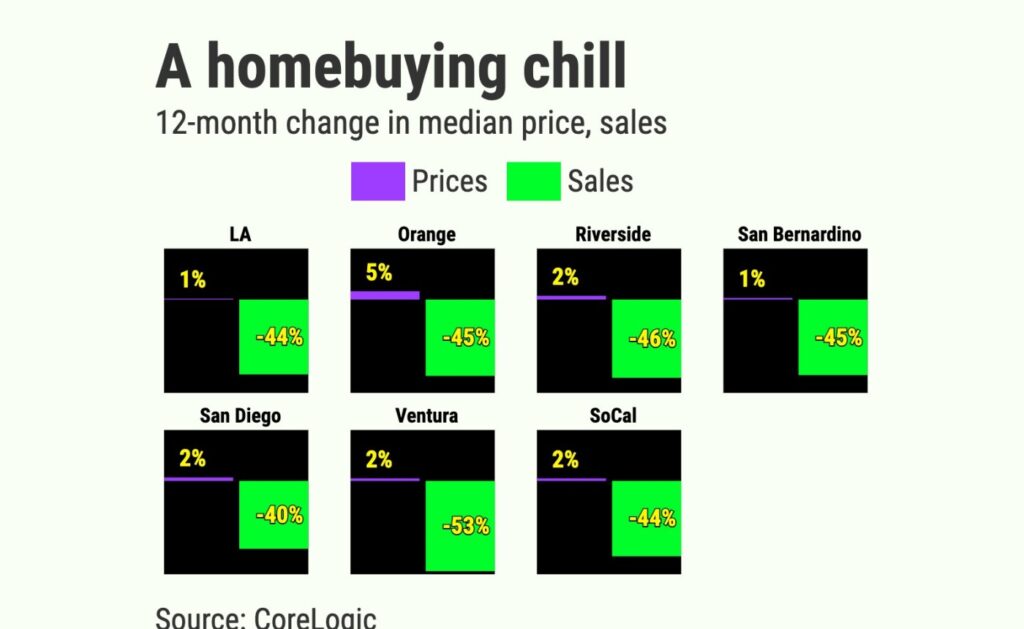

County watch

Here’s a county-by-county breakdown with year-over-year percentage changes, according to CoreLogic data …

Los Angeles County’s median rose 0.5% to $785,000; sales were down 44.1% to 4,118 transactions.

Orange County’s median rose 4.9% to $960,000; sales were down 45% to 1,760 transactions.

Riverside County’s median rose 2.2% to $543,750; sales were down 46.1% to 2,445 transactions.

San Bernardino County’s median rose 0.9% to $466,000; sales were down 44.5% to 1,905 transactions.

San Diego County’s median rose 2% to $765,000; sales were down 40% to 2,288 transactions.

Ventura County’s median rose 1.5% to $761,500; sales were down 53.2% to 500 transactions.