Are you among the 3 million California taxpayers who have yet to receive the state’s Middle Class Tax Refund?

Bah-humbug, indeed!

The latest on this inflation stimulus payment comes with a holiday asterisk. The latest data from the Franchise Tax Board was last updated Dec. 16. The FTB typically updates the distribution numbers every Wednesday, but last week the agency didn’t update the data, perhaps on a vacation break ahead of Christmas.

As of mid-December, the state reported it issued 14,967,941 MCTR payments, either via direct deposit or by debit card. Interestingly, the debit card distribution has now topped the direct deposit flow with 8,011,510 money cards issued vs. 6,956,431 electronic transfers.

Since October, we’ve been updating readers on the MCTR program. Here’s a brief recap:

The state is sending out $9.5 billion in inflation relief funds to roughly 18 million California taxpayers with adjusted gross incomes of less than $500,000. Payments range from $200 for certain high-income earners all the way up to $1,050 for two-filing households with a qualifying dependent.

Similar to the pandemic-related Golden State Stimulus payment programs, recipients of the MCTR must be California residents and tax filers in order to qualify. The state will base relief payments on adjusted gross income found in 2020 tax returns.

The remaining 3 million payments will reach taxpayers in the form of a debit card (or a paper check, but more on that below) between now and mid-January 2023.

So, why so many debit cards vs. direct deposits? Tax filers had to be refund recipients to get an electronic MCTR. If you owed money to California on the 2020 tax return, you’ll get a debit card.

Read more: How to cash California’s Middle Class Tax Refund debit card

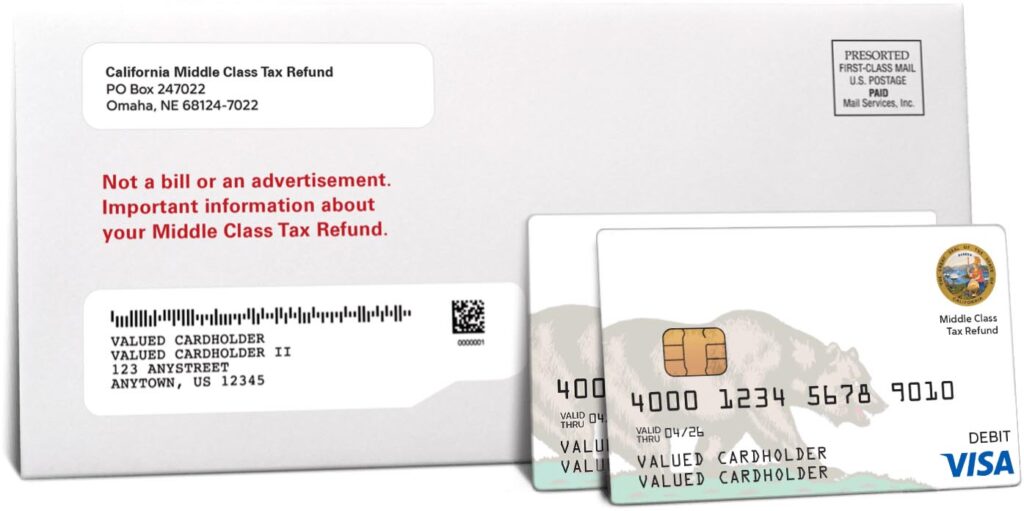

Now, some people aren’t too happy with the terms of the debit card. The cards (stamped with a Golden State grizzly bear) are being issued by New York Community Bank as part of a $25 million contract with card vendor Money Network Financial Inc.

Middle Income Tax Refund debit cards will be distributed to qualifying taxpayers through mid-January. (iStockphoto)

Some reader concerns included:

Activating the card: Once a user calls and activates the card, NYCB opens an account for that user.

FTB’s response: That account is solely linked to the MCTR and will close when the card is depleted.

Readers were quite concerned their data would be sold to third parties, including their Social Security number.

FTB’s response: FTB’s agreement with Money Network permits the use of information received from the state of California for purposes of marketing the issued Middle Class Tax Refund payment debit card.

But reader Johanne G. didn’t take comfort in that response: “I found one place where the information you received from the FTB differs from the NYBC Consumer Privacy Notice. On the first page of the NYBC notice, in the FACTS section, it clearly states that “When you are no longer our customer, we continue to share your information as described in this notice.”

That bank privacy notice also states: “The types of personal information we collect and share depend on the product or service you have with us. This information can include Social Security number and income; account balances and payment history; transaction history and credit history.”

Related: Tips and answers for incoming Middle Income Tax Refund debit cards

On the back of the form, the bank states it “does not share” personal information with its affiliates or non-affiliates. It does, however, have a “formal agreement” between non-affiliated financial companies to market financial services to you.

For any debit card recipient who prefers to skip all that financial mumbo-jumbo, you can opt-out, triggering a paper check, hopefully before next Christmas.

Here are some reminders on how to do that:

—Decline the terms and conditions of the cardholder agreement, causing funds to be returned to FTB, which will then issue a check.

—No contact with FTB is necessary once the individual has called Money Network at 800-542-9332 and declined the terms and conditions of the cardholder agreement. With this option, it may take up to 12 weeks to receive a mailed check.

Those who do agree with the terms and conditions of the cardholder agreement should activate their MCTR debit card and request that Money Network send a check. With this option, it may take up to 10 days to receive a check. They should call 800-240-0223 to activate the debit card and 800-542-9332 to request a check.

When calling the 800-542-9332 customer line it’s important to listen to all options before choosing the correct one. (After listening to the initial message, which is about 2 minutes long, callers can press “9” for an agent.)

Need more info? The state has set up a page at the FTB website where residents can check eligibility and how much they will receive.

And please, keep us informed, too. You can email me at [email protected] with your concerns, experiences and overall MCTR angst. Happy holidays, taxpayers!