Risk-averse people, this is your moment in the spotlight.

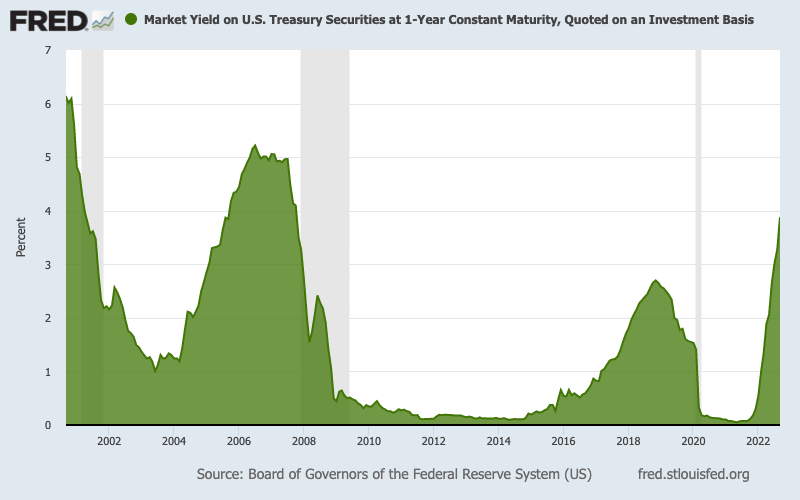

For roughly a decade, the same forces that plunged mortgage rates to record lows made no-risk savings earn next to nothing. But now the Federal Reserve has replaced its cheap money policies with sharp rate hikes.

So it’s a world of 6% mortgage rates — and 4% yields on Treasuries. That means it’s time to sharpen your hunting skills for higher savings rates.

Yes, nobody’s going to get rich at today’s no-risk yields. But the effort can be worthwhile for any spare cash you have sitting in federally backed assets.

Rate shopping means you’ll likely have to open accounts at new banks or other financial institutions. And you’ll have to be comfortable with remote banking to maximize these returns. If you’re a branch-banking fan, there are some opportunities to increase yields at local institutions, too.

Why is Federal Reserve ruining US economy with rate hikes?

Some online sleuthing skills are required. Websites such as Bankrate, NerdWallet or WalletHub track better-paying accounts across the nation and locally. But I’ll note certain saver-friendly institutions run advertisements for accounts with attractive rates in your favorite local newspaper.

You’ll also have to become a diligent reader of fine print. The added income from your effort can be significantly trimmed by various fees — charges for everything from failure to maintain a minimum balance to too much movement of funds in and out.

But the first step is to break your spare cash into two piles: what you might need in the short run and the nest egg than can stay parked for a while. Let’s explain why.

Money markets

If you’ve got spare cash that needs to be easily accessible, banking’s money market accounts can be the best bet for you.

They’re an upgrade from interest-paying checking accounts or traditional savings accounts that often pay next to zero. The trade-off is that money markets typically come with limitations on how often you can withdraw the money.

In return, some banks pay you a decent rate. Bankrate says annual yields average 2% nationwide.

Note: If you need to access this cash more than once or twice a month, fees for frequent activity could cut your returns.

Savings bonds

If you don’t need spare cash in the next five years, the federal government borrows money through an odd consumer-centric investment currently paying a 9.6% annual rate.

That’s the inflation version of the venerable U.S. savings bonds – the so-called “I” bond. Why so high? Well, its rate is derived from the latest inflation numbers.

Of course, there are a few catches with “I” bonds that are sold through a U.S. Treasury website called treasurydirect.gov.

The rate is variable. Starting in November, new inflation data will create the yield for the next six months. (It’s a good bet a payout in the next few years won’t be much lower, but inflation should fall over time!)

Plus, if you want your money back within five years, you lose the previous three months of interest though that may prove to be a small penalty.

You can only buy $10,000 per year, but there’s a congressional push to increase that limit.

Treasury securities

One trick your investment adviser probably won’t tell you is that that same government website — treasurydirect.gov – also will allow you to buy other Treasury-backed investments.

It’s not the friendliest investment site. And you’ll need a minor understanding of how Treasury securities are sold.

But it offers maturities from three months to 30 years with yields at or around 4%. No fees are charged. The site will even automatically reinvest your savings when your security matures if you so desire.

Certificate of deposit

The bank often will pay you a better rate in return if you commit to keeping the money in place for an extended period.

Remember, there are often penalties — sometimes steep — for early withdrawals, so planning is required.

CDs come in almost every maturity imaginable, so make sure you’re comparing apples to apples when rate shopping. The best rates of late have run from nearly 2% for three-month CDs to just over 4% for three-years-plus.

And note that some banks offer “penalty-free CDs” where the yield is a little lower but you can cash out at any time, without any cost.

Brokered CDs

You don’t have to get a certificate of deposit directly from the issuing bank.

Numerous federally insured institutions also sell their CDs in fixed-income markets. This is sort of like how stocks trade, thus the “brokered” name.

And oddly, and to your benefit, brokered CDs typically pay better than what’s found at the same bank’s branches or website.

Your financial guru can probably help you find brokered CDs. Some do-it-yourself brokerage accounts also offer them.

By the way

Related Articles

30-year mortgage rates soar to 6.7%, highest in 15 years

Office space: The real estate crash we need to worry about

California’s ‘racist’ Article 34 remains an obstacle to affordable housing

California has fewest ‘underwater’ homeowners in US

Mortgage rates jump to 6.7%, highest since 2007

Seeking better rates on your savings helps the Federal Reserve cool the economy and tame inflation.

For years, the Fed boosted the economy by giving you nothing on your savings. That was a nudge to bet on risky assets like stocks, bonds and real estate.

Today’s rising rates push folks away from borrowing as well as shifting money from risky assets into safer ones.

That cash flow toward safety helps chill an overheated business climate.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com