In September 1986, a young journalist moved west with the challenge of explaining California’s economy to his audience.

Over 36 years at the Orange County Register — now part of the Southern California News Group — there’s been one universal economic truth: This is a very expensive state.

To mark three dozen years analyzing the Golden State, I’ve used my trusty spreadsheet to grade 36 economic “ingredients” that create the stew that is California’s pricey cost of living. These stats are the most current I could find from government and private industry sources — and I’ve cited in most cases the costs as a household’s yearly expense. On top of goods and services, I also tracked the cost of wages on an annualized basis.

Remember, wages are a business expense that’s passed to consumers. And bigger paychecks give consumers more cash to pay up for pricey items.

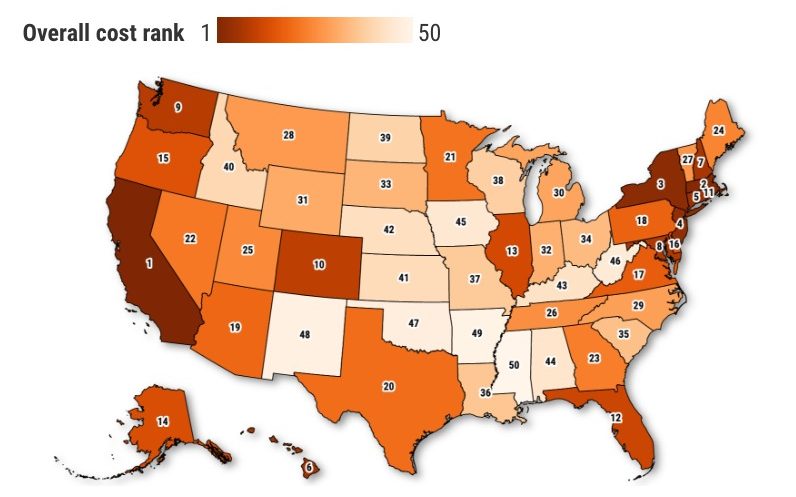

When I averaged these 36 price rankings for each state in the union, California’s cost structure was the nation’s most exorbitant. Massachusetts was next, followed by New York, New Jersey and Connecticut. The biggest bargains, by this math, were in Mississippi, Arkansas, New Mexico, Oklahoma and West Virginia.

Now whether any state is worth its price tag is hard to quantify. But it’s never been easy digesting finances for Californians, today or back in 1986. Consider these 36 expenses and how they compare with the 50-state median and their standing vs. other states.

Top shelf

Let’s start with the costs in California that rank highest among the states.

There’s diesel at $6.32 a gallon statewide, or 28% more than the U.S. median. Yes, there are hefty fuel taxes but the price is also partly due to demand from the state’s huge trucking and logistics industry.

Now you’d think a mild climate might cap apparel expenses. But clothing and footwear spending at $4,000 a year is 54% above the U.S. median. That good California climate helps explain high dining and lodging spending of $8,800 spent a year, 49% above the norm.

Ponder top-paid people. California’s information industries have $265,400 annualized pay — 173% above the norm. Manufacturing wages run $139,300 — 90% above par.

And even though California leisure and hospitality wages are low — $47,800 annualized pay — it’s a national leader and 73% above the U.S. mid-point.

Second tier

Next, consider costs ranking No. 2 in the nation.

Another fuel, this time gasoline, costs $5.27 per gallon for the regular blend, 39% above the national median.

Next, California real estate.

Single-family homes fetch $806,000 — 1.5 times the U.S. median. Condos are valued at $677,000, 46% above par. Rent for a typical Golden State tenant is $1,600 a month, 68% above what other U.S. renters pay. And renters of California houses pay $3,000 a month, 75% above the U.S. mid-point.

Oh, and California’s government workers earn $84,000 annually, also the second-highest and 35% above the norm.

More lofty expenses

Food is pricey. Groceries run $10,600 a year, No. 10 among the states and 9% above the median.

So is fun. Recreation is a $ 4,500-a-year expense, No. 4 and 51% above par.

Getting ill can also make a Californian’s finances sickly.

Californians spend $8,000 on physicians a year, No. 3 among the states and 34% above what’s typical. Hospitals cost a typical household $11,300 a year, No. 10 and 11% above usual. Dentistry? $1,300 a year, No. 10 and a 16% premium.

Paying for that California home can stretch a budget even further.

The electric bill runs $1,800 a year, fifth-highest among the states and 24% more than the median. Having cable TV and internet services can go $1,200 yearly, No. 8 and 27% above the norm.

The $3,400 spent yearly on household furnishings ranks No. 8 and 17% more than typical. Don’t forget water and sewer, which runs $1,600 yearly, No. 11 and 64% above the median.

And the car in the garage? It comes with $2,200 annual insurance premiums, No. 6 among the states and 35% above par.

Note that state income taxes equal 3.8% of the typical household’s income, No. 4 and well above the 2.5% U.S. median. That takes a bite out of high-ranking wages.

Professional services offer $129,500 annualized pay, No. 4 and 54% more than usual. And financial services? $154,000 annualized, No. 4 and 70% above par. The booming trade and transportation sectors’ i$67,900 ranks No. 4 and is 23% above the median. And construction’s $88,600 is No. 6 and 16% above the median.

Yet wages in health and education wages at $66,000 rank No. 15 nationally and are only 3% above the industry’s typical salaries.

Bargains?

Yes, some parts of California’s lifestyle cost near or below typical U.S. prices.

College tuition runs $15,100 a year for in-state students, ranking it No. 23 nationally and only 4% above the U.S. median. Used cars cost $34,600, No. 16 among the states but just 2% above the median. And drugs and medical supplies run $3,300 a year, ranking No. 24 — essentially tied with the national norm.

Some taxes may not be as bad as you think.

Thanks to Proposition 13, property taxes are 2.76% of California’s household income. That’s No. 30 among the states and .a smidge below the 2.81% U.S. median. And 3.16% of Californians’ incomes are spent on sales and excise taxes No. 32 among the states and nearly a quarter-point below the 3.39% national norm.

Nursing expenses run $1,379 a year — No. 33 and 8% below the norm. That low level is due, in part, to the state’s relatively youthful demographics.

Home insurance has been moderate at $2,028 on typical $500,000 home — ninth-lowest and 25% below what’s charged elsewhere. Will wildfire risks change that?

And, finally, there’s $768 spent on natural gas. It ranks eighth-lowest nationally — and 28% below the typical expense. Thank mild climate limiting use by many Californians, not affordable utility rates.

Bottom line

So is the “California premium” worth it?

Ponder the headline-grabbing cost indicator — home prices. Tripled in my first 18 years in the state — and doubled since. That’s a warning sign to any youthful dreamer thinking today of a California relocation that I undertook in 1986.

Related Articles

Sam’s Club boosting basic membership fee for first time in 9 years

Gas prices drop 70 days in a row in the second-longest streak since 2005

Suddenly, the housing market is not all about the sellers

U.S. farmers are killing their own crops and selling cows because of extreme drought

US retail sales were flat in July as inflation takes a toll

A job opportunity brought me west. California employment, the signature marker of economic oomph and a key population magnet, grew 30% from 1986 through 2004. But the state’s added only 15% more workers in the past 18 years.

And while California has 39 million residents, far more than any other state, this popularity measure is now in reverse. Growth has halted — a sharp contrast to a 30% expansion in residents in my first 18 years in the state.

To me, the “price of paradise” is tolerable. But policy makers better know California costs are fitting fewer budgets these days.

I got one kid in Ohio and the other is thinking about Washington state.

PS: The pricing sources, in alphabetical order: AAA, Bankrate, Bureau of Economic Analysis, Bureau of Labor Statistics, Census, Center for Medicare & Medicaid Service, Economic Policy Institute, Federal Housing Finance Agency, Insurance.com, ISeeCars, Move.org, RentCafe, WalletHub, and Zillow.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at [email protected]