Arlington Heights officials rejected a petition to ban village financial incentives for the Chicago Bears or any other business, stating that the petition didn’t have enough valid signatures — and warning that such a move would hurt businesses and taxpayers.

The petition calls for the village to create an “Anti-Corporate Welfare Ordinance” that would prohibit any financial or other incentive to a business to operate in the village. The petition was submitted by Americans for Prosperity Illinois, part of a libertarian group backed by the conservative Koch brothers.

Mayor Tom Hayes called the proposal “a terrible idea,” saying it would prohibit any kind of tax break or even public parking that could be considered a financial incentive for business. He added that any suggestion of cronyism among village officials was “patently false and baseless.”

Last year, the Bears entered into a preliminary purchase agreement to buy Arlington International Racecourse from Churchill Downs Inc. for $197 million. The team is going through due diligence to see whether the 326-acre site would meet all requirements before closing the deal late this year or early next year.

To make a move to Arlington Heights, the team would have to pay to break its lease at Soldier Field in Chicago, where the team has played for half a century. Mayor Lori Lightfoot has proposed topping the stadium with a $2 billion dome.

Team officials have said they would not seek taxpayer assistance to build the stadium but would need public assistance to build infrastructure for the adjoining $5 billion development to feature housing, offices, retail and entertainment.

A village ordinance allows the village board to consider approving a referendum on a petition if it gets supporting signatures from 1% of registered voters, or 557 people.

Americans for Prosperity Illinois submitted 667 signatures Sept. 6, but some signatures didn’t match registered signatures, had no signature, had incorrect or no names, or the signees did not live in Arlington Heights, leaving only 544 valid signatures, Village Manager Randall Recklaus said.

Petitioners may always add more signatures. If the board still rejects the proposal, petitioners may get signatures from 12% of registered voters to put the measure on the ballot.

Americans for Prosperity has said a referendum would be binding, but village attorney Hart Passman said it would not, saying that nothing in the ordinance or state law provides for it to be binding.

Recklaus gave an overview of how tax incentives have been very successful in attracting and keeping businesses that lower homeowners’ property tax burden.

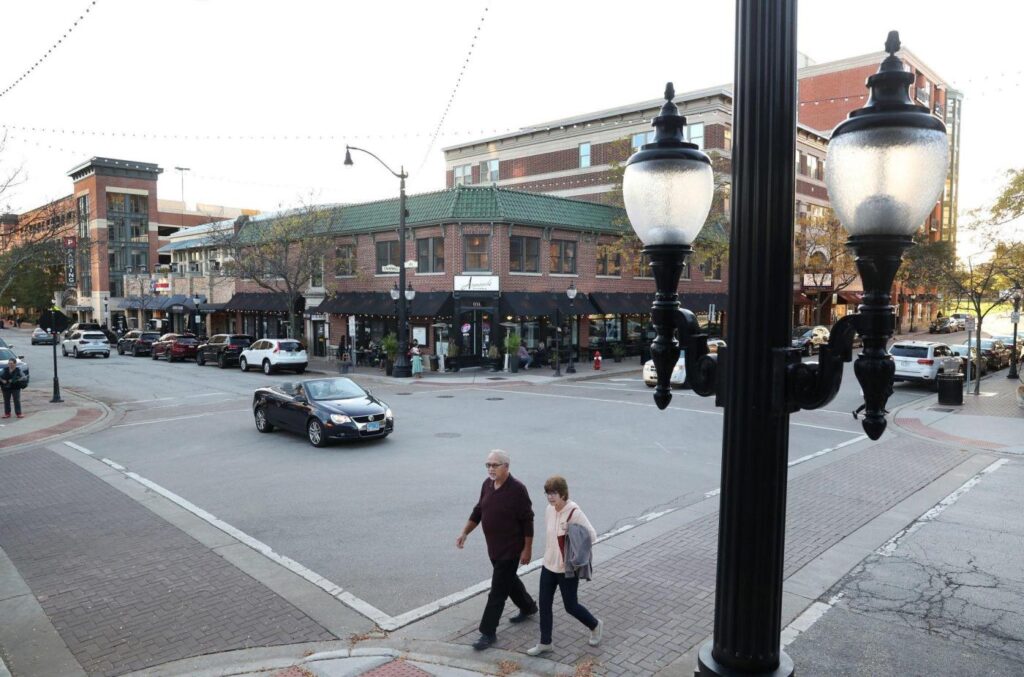

Most significantly, he said, the village’s downtown was successfully rebuilt through a Tax Increment Financing, or TIF, district. Under the TIF, any increases in property taxes from downtown were plowed back into improvements of the area, such as utilities and roads.

While the TIF was in effect from 1983 to 2006, annual property tax revenue increased from $650,000 to $6.5 million, he said. Once the TIF expired after 23 years, that money was distributed to all local taxing bodies.

The result has been a thriving downtown, with high-rise condominiums and apartments, restaurants, a theater and three public parking areas. A ban on incentives could even be interpreted to ban public parking, and to eliminate use of village streets for the downtown’s al fresco dining, Recklaus said.

Other village programs have provided sales tax rebates and low-interest or forgivable loans to help businesses survive the COVID pandemic or other issues.

In the case of the Bears, a TIF could pay for new sewers and other infrastructure, such as proposed new ramps to take traffic from Route 53 under Northwest Highway and railroad tracks to the stadium.

While some TIFs and stadium projects elsewhere have failed, Recklaus said, any new Arlington Heights TIF would only be approved if it is shown that it would generate revenue to more than pay for all village expenses. Prohibiting such deals would put the village at a severe competitive disadvantage, and likely diminish its tax base.

Americans for Prosperity released a recent poll which found that 68% of Arlington Heights voters polled opposed using tax dollars for the Bears, compared with 22% in support. The poll also found that 55% supported the anti-corporate welfare ordinance.

The group’s deputy state director, Brian Costin, previously issued a statement that read: ”Arlington Heights is proposing the largest corporate welfare deal in Village history for a billionaire owner in the richest sports entertainment company in the world. Not only is this special treatment unfair to residents and other business owners, but a vast majority of economists polled on sports stadium subsidies found them to be a bad deal for taxpayers.”

()