Let me attempt — feebly, I may add — to spin Southern California’s soaring cost of living: Do you feel better knowing inflation rates are higher elsewhere?

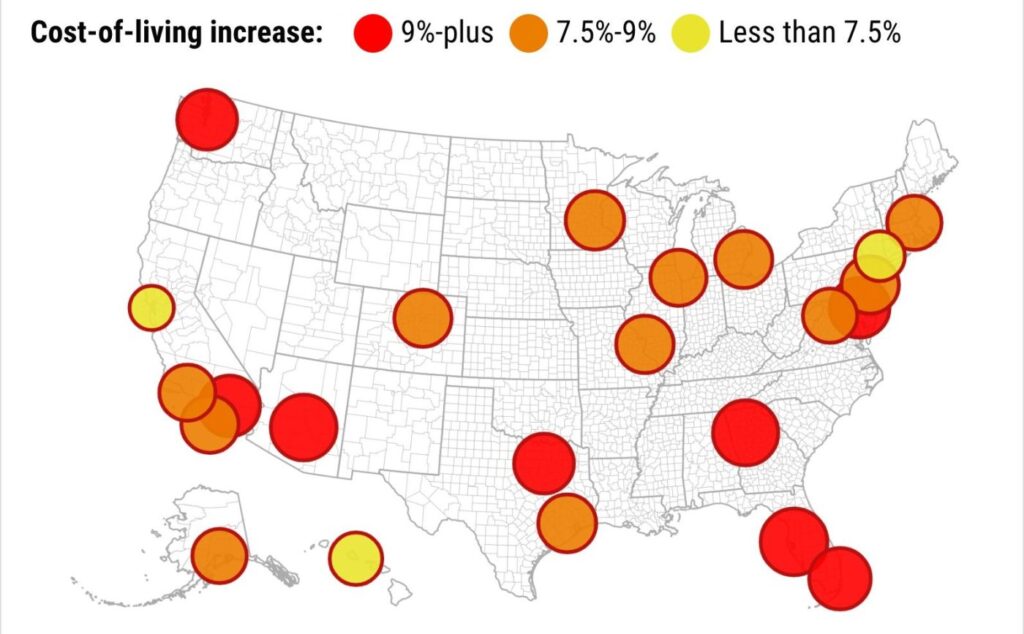

According to the Consumer Price Index report for May, the nation’s inflation rate hit a 40-year high at 8.6%, up from 8.3% in April. The news wasn’t any better within the 23 metropolitan areas that are tracked by the CPI, mostly on a bimonthly basis.

My trusty spreadsheet’s analysis shows inflation in Riverside and San Bernardino counties jumping to 9.4% in the year ended in May, according to the Inland Empire’s a bimonthly CPI. That ranked fifth-highest among the latest inflation readings for U.S. 23 metros tracked.

Consider the Inland Empire’s two-month CPI change from March to get a peek at short-term pricing. It’s not pretty, as on an annualized basis it translates to a 12% inflation rate — and that ranked No. 8 of the 23.

Inflation nationwide, by the same math, ran at a 6.8% annualized rate the past two months. Could that signal some sort of cost-of-living moderation?

May’s L.A.-O.C. rate of 8% — a monthly index — ranked No. 16 of 23. Its two-month change translates to a 3.2% annualized inflation rate — third-lowest among the 23 regions.

Lots to blame

This national bout of inflation — the worst in four decades — can be tied to a host of issues. There were policy missteps that overstimulated the economy, and skyrocketing oil and gas prices — heavily tied to Russia’s invasion of Ukraine. All of that is driving up prices.

Shortages of various goods — baby formula and now sriracha are the latest examples — don’t help. Consumers flush with money after two years in pandemic purgatory are thinning store shelves and warehouses. A worker shortage is pushing up wages and adding to production challenges.

The cities harder hit by inflation than the Inland Empire tell an economic story, too.

At the top of the charts, combining May and April bimonthly CPI reports, are Southern metros that have drawn flocks of new residents in the pandemic era.

And inflation is less severe in economies that have yet to fully recover from the coronavirus chill on business — in the Northeast and on the Pacific coast.

CPI cityscape

Tampa was the national inflation hot spot, with local CPI up 11.3% for the year ended in May.

Perhaps, that’s a peak. The Florida city’s index rose at a 6.8% annualized pace in the last two months, fifth-lowest nationally.

No. 2 Phoenix: 11% vs. 16% annualized two months, No. 1.

No. 3 Atlanta: 10.8% vs. 12% annualized two months, No. 8.

No. 4 Miami: 9.6% vs. 9.3% annualized two months, No. 15.

Following the Inland Empire were …

No. 6 Baltimore: 9.1% vs. 10% annualized last two months, No. 13.

No. 6 Seattle: 9.1% vs. 13.3% annualized two months, No. 6.

No. 6 Dallas: 9.1% vs. 6.8% annualized two months, No. 19.related_articles location=”left” show_article_date=”false” article_type=”automatic-primary-tag”]

No. 9 Minneapolis: 8.7% vs. 8.1% annualized two months, No. 18.

No. 10 Houston: 8.5% vs. 15.3% annualized two months, No. 3.

No. 11 Philadelphia: 8.4% vs. 13.9% annualized two months, No. 5.

No. 11 St. Louis: 8.4% vs. 14.6% annualized two months, No. 4.

No. 13 Detroit: 8.3% vs. 16% annualized two months, No. 1.

No. 13 Denver: 8.3% vs. 11.3% annualized two months, No. 11.

No. 13 San Diego: 8.3% vs. 8.7% annualized two months, No. 17.

Tied at No. 16 with L.A.-O.C. was Chicago’s 8% rate. The Windy City’s 11.3% annualized inflation for the last two months ranked No. 11. The metros with less inflation were …

No. 18 Anchorage: 7.5% in the year vs. 12% annualized last two months, No. 8.

No. 18 Boston: 7.5% vs. unchanged last two months, lowest of the 23.

No. 18 Washington: 7.5% vs. 10% annualized two months, No. 13.

No. 21 Honolulu: 7% vs. 13.3% annualized two months, No. 6.

No. 22 New York: 6.3% vs. 3% annualized two months, No. 22.

Last was San Francisco at 5%. But Bay Area residents should note a 9.3% annualized rate for the previous last two months — that ranked No. 15.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com