”Survey says” looks at various rankings and scorecards judging geographic locations, noting that these grades are best seen as a mix of artful interpretation and data.

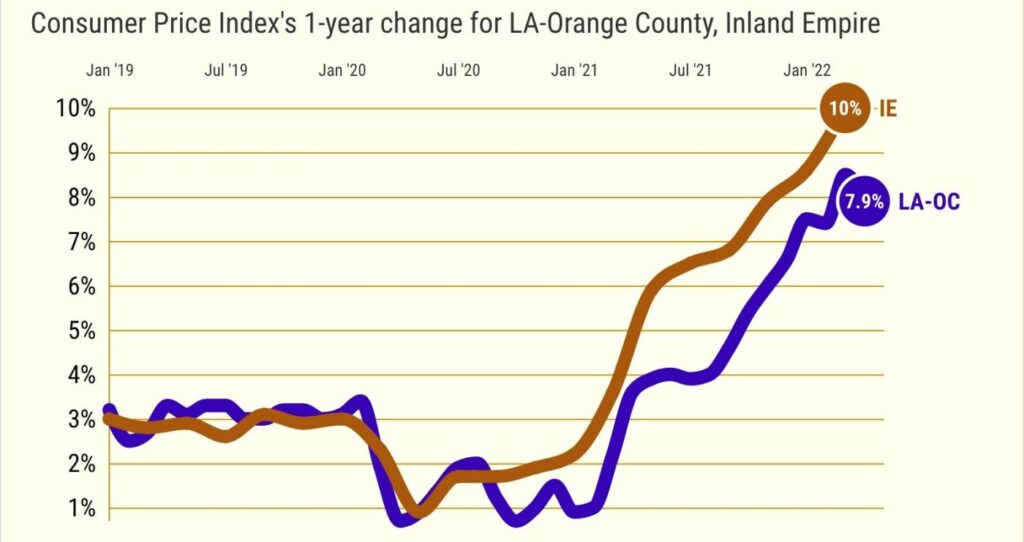

Buzz: April’s inflation report included a bit of good news for Los Angeles and Orange counties — the upswing in the cost of living slowed a tiny bit. Still, it was the second-worst jump in the local cost of living in four decades.

Source: My trusty spreadsheet looked at surging inflation rates for the L.A.-O.C. metropolitan area in April, as measured by the Bureau of Labor Statistics’ Consumer Price Index.

Topline

Local inflation ran at an annual pace of 7.9% in April. That’s slower than the nation’s 8.3% pace. It’s also below the 8.5% L.A.-O.C. rate in March.

End of good news. Last month’s rate was more than double the 3.6% inflation of April 2021.

This is not normal. The last time local inflation was higher before this latest price burst was June 1982.

How long ago was that?

The Lakers won their eighth basketball title that month — they now have 17. Star Trek II was a box office hit — there are now 13 films in this sci-fi franchise. And a Southern California gallon of gasoline cost $1.32 — nearly double what it was in 1978.

What’s up

Inflation’s 2022 pain can be tied to numerous factors that overheated the economy.

Some of it stemmed from “too much good stuff” such as plentiful job opportunities, investment windfalls and historically cheap interest rates.

Some of it is “bad stuff,” like the war in Ukraine and a stubborn pandemic playing havoc with business operations and consumer habits.

All the good and bad added up to a shortfall of workers, manufacturing headaches and supply-chains challenges that have morphed into a shortage of goods and materials used by consumers and corporations. So, the flush wallets of shoppers and CEOs alike — at least until very recently — have been chasing too few goods and services.

Think back to when coronavirus first iced the business climate. For 2020, the local CPI increased only 1.6% — after rising at what then was thought as a problematic 3.4% annual pace in 2018-19.

Ugly details

Let’s start by looking at the high costs associated with goods we buy, along with L.A.-O.C.’s price changes over 12 months that ended in April …

Fuel: You see the service-station street signs. Gasoline cost 46% more vs. a year ago, by CPI math.

Household energy: The monthly utility bill hurts. Electricity? 14% more. Natural gas? 25% costlier.

Food: Eating out got 5.2% pricier. That makes a trip to the supermarket seem like a bargain. Grocery prices rose 9.5%.

Apparel: Looking good is modestly costlier, up 4%.

Big-ticket items: The cost of durable goods such as appliances and furniture was up 11%.

Vehicles: Near-empty car lots translated to a spike in used autos prices, up 21.9%. New ones, when you can find one, are 10.7% pricier.

Related Articles

US inflation dips from 4-decade high but still causing pain

Will Fed’s inflation fight cost Californians their jobs?

Stocks end rocky week with their 5th straight weekly decline

US added 428,000 jobs in April despite surging inflation

Fed raises key rate by a half-point in bid to tame inflation

Next, peek at the costs of local services over the last year …

Overall services: Getting others to get your stuff done is collectively 5.7% pricier.

Housing: By this broad measure — a household’s largest expense — rose 5.4%. CPI math says rent alone was 3.7% pricier.

Medical: Don’t get sick! Hospital and doctor bills are 7% costlier.

Recreation: The cost of fun? A relatively minor 3.6% increase.

Education, child care: Maybe you got a nice raise. But these key kid costs are up 11%.

Bottom line

Some economists like to eyeball an odd CPI slice — inflation, minus food and energy. The logic, if there is any, is trying to measure the cost of living without two volatile spending niches — not that anybody could live without them.

Still, April’s so-called “core” inflation rate for L.A.-O.C. was 5.8% — that’s below readings for February and March, but before those months, it was the highest rate since 1990.

Other gurus think the cost of housing is badly underestimated by the CPI. Ponder local inflation, without housing expenses. It’s up 10.2% in a year, by CPI math.

Clearly, this pain in the wallet requires some relief. April’s 7.3% rise in alcoholic beverage prices suggests one coping mechanism.

Elsewhere

This isn’t some “price of paradise” Southern California quirk.

When you look at the latest inflation reports for metropolitan areas tracked by the CPI, L.A.-O.C. had the No. 9 lowest inflation rate of the 23 regions covered in the past two months.

Pacific states? An 8.5% jump in the CPI for California, Alaska, Hawaii, Oregon and Washington.

Inland Empire? Inflation of 10% two months ago, the latest bi-monthly reading of overall inflation for Riverside and San Bernardino counties.

Other western towns? Bay Area inflation? Rose at a 5% rate in April — the U.S. low. Seattle was at 9.1%. And Phoenix’s 11% jump was the nation’s worst CPI surge.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com