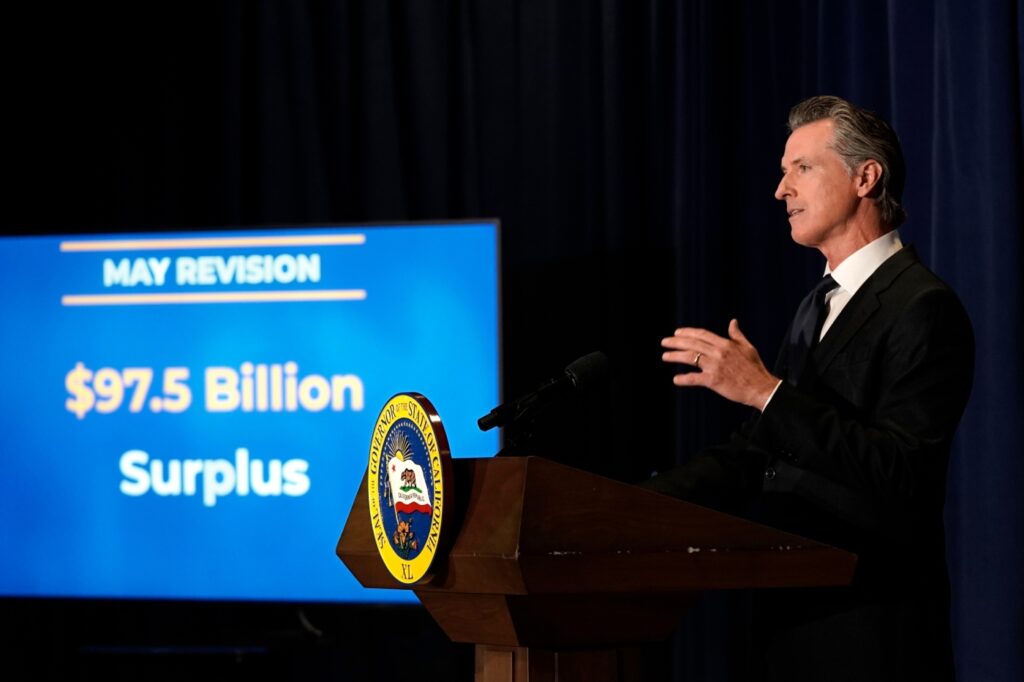

The truly astonishing tax revenue numbers cited by Gov. Gavin Newsom last week as he unveiled a revised state budget bring to mind an old adage: “The bigger they are, the harder they fall.”

So much money is pouring into state coffers from personal and corporate income taxes and sales taxes that Newsom said the state will have nearly $100 billion more than it needs to finance ongoing spending, twice as much as his original budget, proposed in January, estimated.

“You’ve never seen a number like this,” Newsom told reporters.

True enough, and it poses a potential problem that could be just as monumental. Big budget surpluses generate big demands for new spending from the advocates of educational, social welfare and medical services. But if spent on new entitlements, they become liabilities when, inevitably, the economy cools and revenues decline.

Boom and bust budgets plagued the state for decades as personal income taxes became the largest revenue source with much of them coming from a relative few high-income taxpayers. Their incomes, largely from capital gains on investments, were and are more volatile than those of ordinary people and when they declined, it had a disproportionately heavy impact on the state’s finances.

The revised California budget projects $214.2 billion in direct general fund taxes, with personal income taxes supplying 64% of that. Roughly half of those income taxes come from the top 1% of taxpayers, fewer than 200,000 people in a state of nearly 40 million residents.

In introducing the revised budget, Newsom said he is “very mindful” of potential volatility and is responding by putting more money into reserves and making very few new permanent and long-term spending commitments.

About half of the projected surplus must, by law, go to public education and expanding the “rainy day fund” and other reserves to nearly $40 billion. That leaves an estimated $49 billion of so-called “discretionary income” that could be spent on anything he and legislators want.

Newsom says his budget would devote 94% of that pot of money to one-time allocations or paying down debt to avoid long-term commitments that could backfire should the economy cool and revenues decline. “This is important,” he said of that strategy.

Yes it is, because the advocates of expanded entitlements and their legislative allies contend that the surplus is a golden opportunity to fill gaps. Within minutes of Newsom’s budget press conference (which was 132 minutes long, incidentally) advocacy groups were expressing disappointment.

The question posed by the astonishingly high revenue numbers is whether the good times — at least the good times for high-income taxpayers — will continue.

As the budget revision was being finalized, the world, the nation and California were experiencing some troubling trends that Newsom acknowledged.

Related Articles

Survivors of sexual abuse at the California Legislature and public universities shouldn’t be excluded

It’s not corporate greed driving high gas prices, despite what politicians say

Newsom hops on inflation and abortion issues

Return our taxes and fix infrastructure

To empower patients, price transparency is key

“This May revision reflects a significantly upgraded revenue forecast due to recent cash trends and improvement in key economic indicators,” Newsom told the Legislature. “However, the forecast has become more uncertain given Russia’s war on Ukraine, high rates of inflation, and anticipated actions by the Federal Reserve to raise interest rates. In addition, capital gains as a percent of the state’s personal income are at levels last seen in 1999 — just before the dot-com bust. Furthermore, the May revision forecast was finalized before the recent declines in the stock market.”

California is not an economic island and those potentially negative factors are beyond the state’s control. However, the budget’s very rosy revenue projections ignore them and assume that the golden geese, California’s high-income taxpayers, will continue to prosper and continue laying golden eggs.

CalMatters is a public interest journalism venture committed to explaining how California’s state Capitol works and why it matters. For more stories by Dan Walters, go to calmatters.org/commentary.