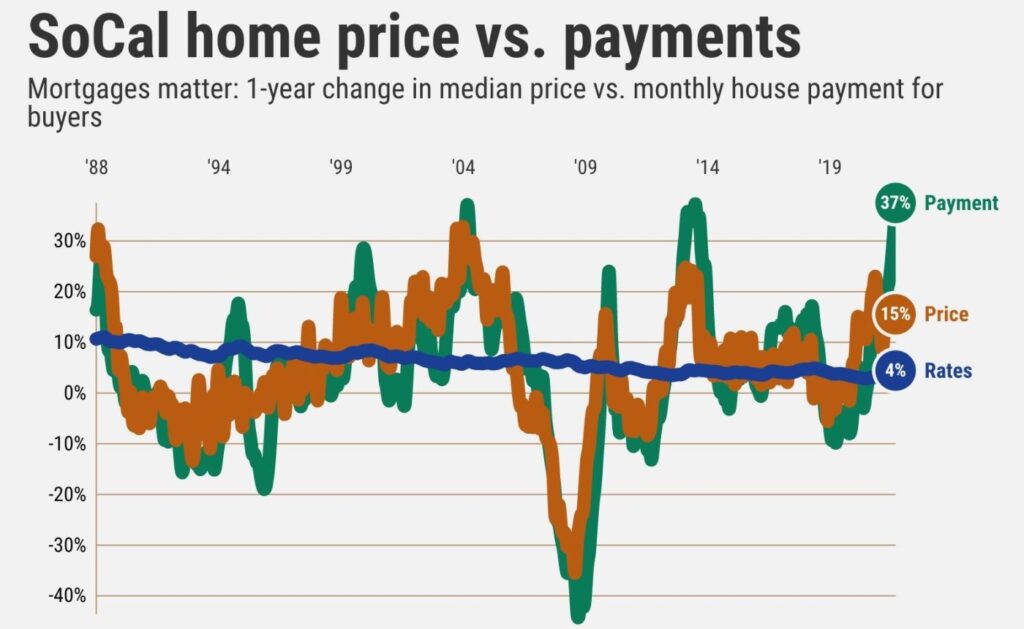

“Payment Pulse” deals with the gut-twisting reality of Southern California homebuying finances. It’s really about the size of the monthly check to the lender, not the headline-grabbing, rising median sales price.

Buzz: A mix of high home prices and soaring mortgage rates proved an expensive mix for Southern California homebuyers in April.

Buyers who financed a median-priced home at $760,000 got a record-breaking $3,010 house payment, up 37% in 12 months and the largest jump ever.

If you think that’s high, payments in Orange County topped $4,000, and the region’s “bargain” San Bernardino County just crossed $2,000.

Other record-smashing, one-year surges in the estimated payments were found in Riverside and San Diego counties.

Source: My trusty spreadsheet looked at the messy intersection of skyrocketing home prices (the monthly median from DQNews) and climbing mortgage rates (the average 30-year deals from Freddie Mac) dating to 1988. Using that data, we generated a hypothetical but typical monthly house payment a buyer would get, assuming a 20% downpayment. The total did not account for property taxes, association dues or insurance.

Rate watch: Mortgage costs are soaring as the Federal Reserve tries to cool an overheated economy that’s pushing up inflation and overpricing assets. In April, the three-month average mortgage rate jumped to 4.3% vs. 3.8% the previous month and 3% a year earlier.

What’s that mean to a borrower’s buying power? In just one month, lenders would give out 6% less money for the same loan payment. Over the past year, it’s a 15% decrease — a cut larger than 99% of all 12-month periods since 1988.

The pain

From March to April alone, the estimated monthly payment jumped $272 or 10%. In a year, the payment is up $819 — a stunning 37% hike that broke a record for increases last set in 2013.

Note, the median price, by itself, is up only 17% over 12 months.

And do not forget that this math assumes a 20% downpayment of $152,000. That’s not an easy nest egg to build. This additional financial burden has grown by $10,800 in the past year.

So it is any wonder that April’s six-county sales count was off 19% from a year ago?

The sales slump is also a historically noteworthy chill. Since 1988, there have been just 44 months with steeper purchasing declines. Or, you can say it’s been worse only 11% of the time.

Locally speaking

Let’s look at the same math found within the counties …

Los Angeles: The record-high $3,426 payment comes as the county’s median sales price hit $865,000. In a month, the payment jumped $297 or 9.5%. In a year it’s up $901 or 36%. The median price is up 15% over 12 months. And 20% down means finding $173,000 — up $22,950 in a year.

Related Articles

US housing starts, building permits stall as mortgage rates bite

House hunters triple use of adjustable-rate mortgages

Mortgage rates hit 5.3%, highest since July 2009

As interest rates rise, lenders offer creative mortgages, incentives

Mortgage rates hit 5.27%, highest since 2009

Orange: Record-high $4,159 payment for a record $1.05 million median. In the month, it’s up $359 or 9.5%. In a year, the payment’s up $1,227 or a record-setting 42%. The median price is up 21% over 12 months. And 20% down is $210,000 — up $35,800 in a year.

Riverside: Record-high $2,337 payment on the peak $590,000 median. In the month, $176 or 8.2% higher. Year’s rise: $688 or a record-setting 42%. Median: Up 20% over 12 months. And 20% down is $118,000 — up $20,000 in a year.

San Bernardino: Record-high $2,056 payment on the peak $519,000 median. In the month, $212 or 11.5% higher. Year’s rise: $598 or 41%. Median: Up 20% over 12 months. And 20% down is $103,800 — up $17,200 in a year.

San Diego: Record-high $3,328 payment on the peak $840,250 median. In the month, $330 or 11% higher. Year’s rise: $972 or a record-setting 41%. Median: Up 20% over 12 months. And 20% down is $168,050 — up $28,050 in a year.

Ventura: Record-high $3,228 payment on the peak $815,000 median. In the month, $341 or 11.8% higher. Year’s rise: $850 or 36%. Median: Up 15% over 12 months. And 20% down is $163,000 — up $21,700 in a year.

Bottom line

Some industry cheerleaders attempt to minimize the current market’s financial challenges by adjusting their math to include inflation’s impact.

Fine. After subtracting the rising cost of living back to 1988, April’s house payment in Southern California wasn’t a record. Still, it was higher than 92% of all months.

And this kind of historical context — minus inflation — by county? Los Angeles tops 94% of all months, Orange (94%), San Bernardino (92%), San Diego (91%), Riverside (89%), and Ventura (82%).

No matter how you slice the data, local homebuying is unnervingly pricey.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com