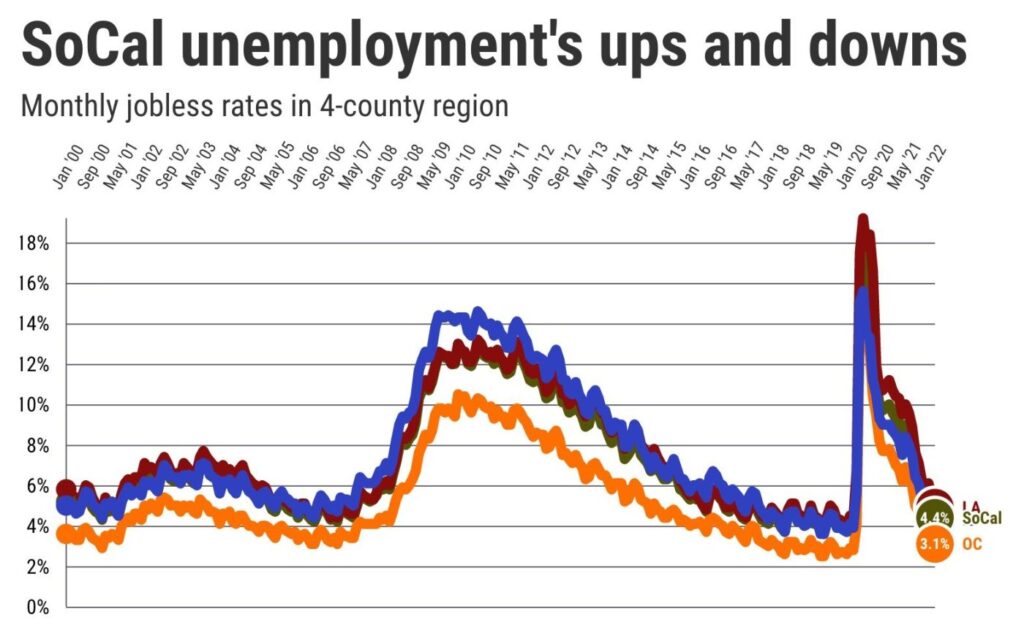

Southern California’s jobless rate in March fell to 4.4% — a pandemic-era low — despite a slowdown in the hiring pace.

My trusty spreadsheet, filled with state job figures, found that combined unemployment in the four counties covered by the Southern California News Group declined from 5% the previous month.

Unemployment in Los Angeles, Orange, Riverside and San Bernardino counties was 3.9% in February 2020, the last month before coronavirus chilled the economy. Joblessness peaked at 17.6% in May 2020.

Local bosses in the four counties added 31,800 jobs in March to 7.75 million employees, up 0.4% in a month and 6.7% in a year.

Last month’s hiring compares to adding 99,000 jobs the previous month and 489,000 over 12 months. Hiring has averaged a 47,000 monthly pace in the recovery from the pandemic jobs bottom of April 2020 amid lockdowns limiting the virus’ spread.

Despite this noteworthy hiring rebound from lockdowns that once iced the economy, total employment is still 98% of February 2020.

So far, it’s been a split recovery. Employment in eateries, tourism and entertainment is at 869,600 — 91% of pre-pandemic staffing vs. 99% for the rest of the economy. These “fun” businesses — with 11% of local jobs — added 12,700 workers last month or 40% of all hires.

In SoCal’s metropolitan areas …

Los Angeles County: 4.48 million workers are 97% of pre-virus jobs — down 140,700 after adding 13,300 last month. Recovery pace? Up 26,800 a month. Unemployment? 4.9% this month vs. 5.4% previous month vs. 10.4% a year earlier.

Orange County: 1.63 million workers are 96.9% of pre-virus jobs — down 51,700 after adding 9,800 last month. Recovery pace? Up 9,100 a month. Unemployment? 3.1% this month vs. 3.7% previous month vs. 7% a year earlier.

Riverside and San Bernardino counties: 1.63 million workers are 102.9% of pre-virus jobs — up 46,400 after adding 8,700 last month. Recovery pace? Up 11,100 a month. Unemployment? 4.3% this month vs. 5% previous month vs. 8.5% a year earlier.

Here’s how Southern California employment niches fared in March, ranked by performance in the pandemic era …

Transportation/warehouses: 119% of pre-coronavirus jobs — 452,400 workers are up 71,800 from February 2020. That’s after dropping 3,700 last month vs. averaging 4,200 new jobs a month in the recovery.

Healthcare, personal services: 101% of pre-coronavirus jobs — 1.18 million workers are up 15,300 from February 2020. That’s after adding 5,400 last month vs. jobs growing 5,100 monthly in the recovery from the April 2020 pandemic era’s low.

Business services: 100% of pre-coronavirus jobs — 1.15 million workers are up 4,000 from February 2020. That’s after dropping 500 last month vs. jobs growing 6,600 monthly in the recovery.

Retailing: 99.9% of pre-virus employment — 735,000 workers are down 3,200 from February 2020. That’s after dropping 1,200 last month vs. jobs growing 6,100 monthly in the recovery.

Construction, real estate, finance: 98% of pre-pandemic staffing — 658,500 workers are down 15,700 from February 2020. That’s after adding 8,500 last month vs. jobs growing 2,500 monthly in the recovery.

Government: 95% of pre-pandemic staffing — 985,300 workers are down 46,500 from February 2020. That’s after adding 4,100 last month vs. jobs dipping 900 monthly in the recovery.

Manufacturing: 95% of pre-virus employment — 564,700 workers are down 31,700 from February 2020. That’s after adding 1,800 last month vs. jobs growing 1,600 monthly in the recovery.

Restaurants: Last month was 95% of pre-pandemic jobs — 643,500 workers are down 37,200 from February 2020. That’s after adding 7,500 last month vs. jobs growing 11,000 monthly in the recovery.

Arts, entertainment and recreation: 88% of pre-pandemic staffing — 153,400 workers are down 21,500 from February 2020. That’s after adding 3,000 last month vs. jobs growing 2,200 monthly in the recovery.

Hotels: 75% of pre-virus employment — 72,700 workers are down 24,200 from February 2020. That’s after adding 2,200 last month vs. jobs growing 1,000 monthly in the recovery.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com