The “Looking Glass” ponders economic and real estate trends through two distinct lenses: the optimist’s “glass half-full” and the pessimist’s “glass half-empty.”

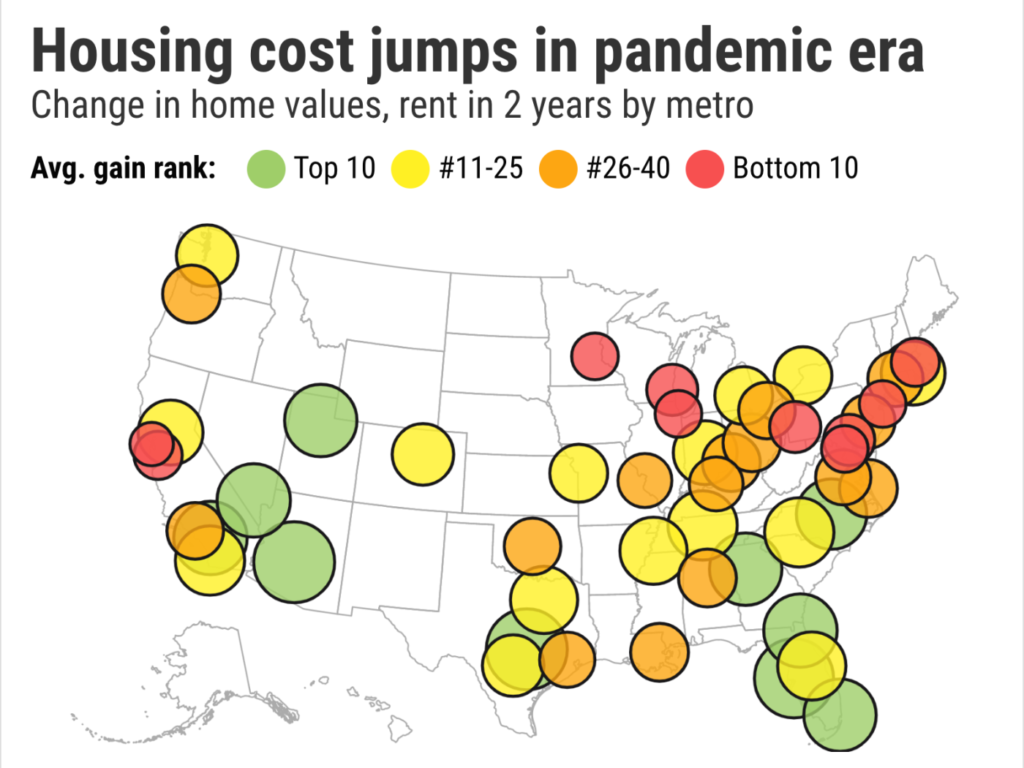

Buzz: Home seekers in Riverside and San Bernardino counties — whether their hunt is to buy or to rent — have seen costs soar in the pandemic era nearly as much as anywhere in the nation.

Debate: How long can Inland Empire housing stay an “affordable” place to live?

Source: My trusty spreadsheet’s review of Zillow stats on home values and rents in the nation’s 50 largest metropolitan areas — a roster that includes six in California. Key figure: The two-year changes since February 2020, the last time the economy was coronavirus-free.

Glass half-full

Inland Empire still has California’s cheapest homes among its six big metros.

The typical $555,853 value is below Sacramento’s $595,005, San Diego’s $880,414, Los Angeles-Orange County’s $892,558; San Francisco’s $1.43 million and San Jose’s $1.63 million.

Those last three metros are the nation’s priciest vs. the U.S. lows of Oklahoma City at $204,073, Cleveland at $204,808, and Pittsburgh at $206,604.

As for typical rents, Inland Empire at $2,537 a month is cheaper statewide than all but Sacramento’s $2,212. Next up the price scale is San Diego at $2,778, L.A.-O.C. at $2,816, San Jose at $3,059 and San Francisco at $3,084.

U.S. highs? San Francisco and San Jose then Miami at $2,871. Lows? Buffalo at $1,132, Milwaukee at $1,179, and Louisville at $1,196.

Glass half-empty

Riverside and San Bernardino counties rank high among U.S. metros for big jumps in home values and rents in the pandemic era.

The Inland Empire’s 43.6% home-price gain at over two years was California’s No. 2 increase and No. 8 among the 50 big U.S. metros.

Statewide, it trailed only San Diego’s at 44%. Next came Sacramento, at 37% then L.A.-O.C. and San Jose at 30%, and San Francisco at 26%.

U.S. highs? Austin at 69%, Phoenix at 55%, and Tampa at 50%. Lows? New York at 21%, Baltimore and Washington, D.C., at 22%.

Renters felt similar price pain. Inland Empire had California’s biggest rent hike at 31% in two years — a jump that ranked fifth-largest nationally.

Next statewide was San Diego at 22%, Sacramento at 21%, L.A.-O.C. at 14%, San Jose at 2% and San Francisco at 1%.

Related Articles

Housing crisis, pandemic reshaping Southern California population

Garden Plaza housing, shopping project needs Mission Viejo leaders to allow mixed uses

4 LA County cities, including Redondo Beach, Whittier, file legal challenge against state housing bill

Orange County adds 23 million-dollar ZIPs, loses 28 ‘bargain’ communities in pandemic era

Gen Z renters leading rush back into Bay Area apartments

Biggest rent hikes nationally were Tampa and Miami at 37%, and Phoenix at 35%. San Francisco and San Jose were the national lows followed by Boston at 5.5%;.

What’s ahead

Riverside and San Bernardino counties have long provided an “affordable” living alternative for the budget-conscious Southern Californians. The pandemic created a need for larger living spaces and reduced commutes — a double-plus for moving inland from the coast.

But that rush created by the odd pandemic economy thinned Inland Empire’s housing savings.

Two years ago, a typical Inland Empire home was 43% cheaper than L.A.-O.C., according to Zillow values. In 2022, prices are just 38% lower.

Tenant savings narrowed far more dramatically. In 2020, Inland Empire rents were 22% cheaper. Today, just 10%.

Or look at the limited savings possibilities this way: Only seven big U.S. metros have pricier homes than Riverside and San Bernardino counties in 2022 — and just 12 have rents that are more expensive.

Jonathan Lansner is business columnist for the Southern California News Group. He can be reached at [email protected]