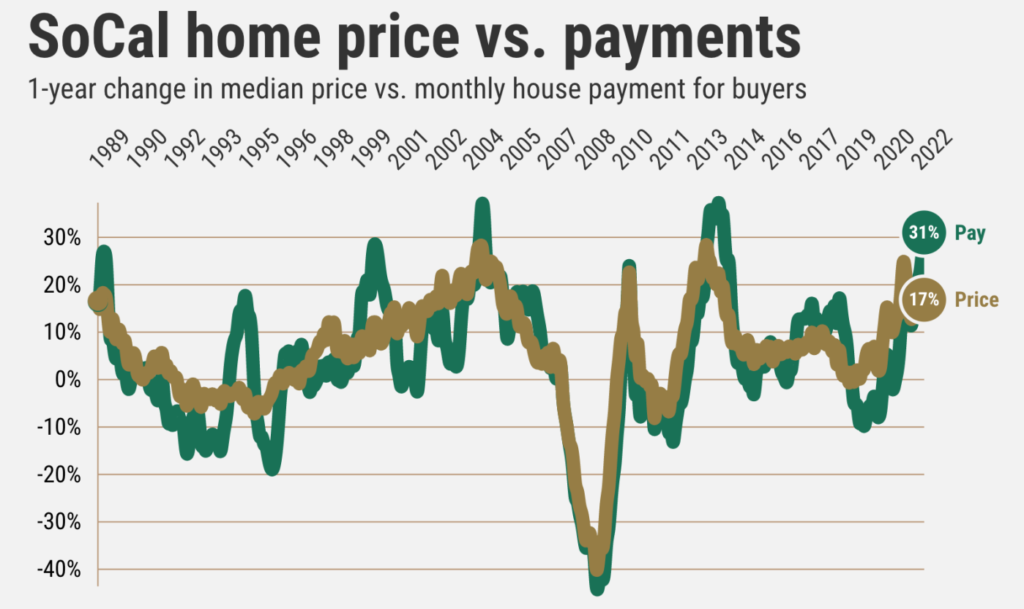

“Payment Pulse” deals with the hearth-wrenching reality of Southern California homebuying finances — it’s really about the size of the monthly check to the lender, not the enormity of price tag.

Buzz: A typical Southern California homebuyer in March landed a house payment almost one-third higher than a year ago.

Source: My trusty spreadsheet looked at what’s become a blood-boiling mix: the intersection of higher home prices (monthly median from DQNews) and rising mortgage rates (average 30-year deals from Freddie Mac) that generate a hypothetical yet typical monthly home loan payment a buyer would get, assuming a 20% downpayment. Note: We do not account for property taxes, association dues or insurance.

Rate watch: 3.79% three-month average vs. 3.44% the previous month and 2.88% a year earlier. What does the do to a borrower’s buying power? In one month, it’s down 4.3% and down 10.9% in a year — a drop larger than 96% of all 12-month periods since 1988.

Pay to the order of …

In the six-county region, last month’s buyer got a record-high $2,738 house payment for the record median home price of $735,000.

The estimated payment is 8.8% higher just in a month. And over a year, it’s up 31% or a $646 a month payment jump heading to the lender. The median by itself is up 17% over 12 months.

Do not forget that this math assumes a $147,000 downpayment — that’s 20% — a financial burden that’s grown by $21,000 in a year.

Locally speaking

My spreadsheet found the same payment trends within each of the counties …

Los Angeles: Record-high $3,129 payment on the record $840,000 median. Payment change: 26% in a year, or $639 a month. The median price was up 12% over 12 months. The 20% downpayment was $168,000 — up $18,000 in a year.

Orange: Record-high $3,799 payment on the record $1,020,000 median. The loan payment was up 37% in a year, or $1,027 a month. The median home price was up 22% over 12 months. And the downpayment was $204,000 — up $37,000 in a year.

Related Articles

U.S. mortgage applications decline as rates hit 12-year high

U.S. economy to see ‘modest recession’ next year, Fannie Mae says

Fed hints at larger rate hikes as inflation fears grow

Why higher mortgage rates aren’t stalling home prices

Reverse mortgage knockoff available for seniors 55 and over

Riverside: $2,160 payment on the record $580,000 median. That payment was flat compared with the all-time high. The loan payment was up 36% in a year, or $577 a month. The median home price was up 22% over 12 months. Downpayment was up $116,000 — or $20,600 in a year.

San Bernardino: $1,844 payment on the record $495,000 median. That payment was 2% below the all-time high. The loan payment was up 29% in a year or $416 a month. The median price was up 15% over 12 months, and the downpayment was $99,000, up $13,000 in a year.

San Diego: Record-high $2,998 payment on the record $805,000 median. The loan payment was up 33% in a year or $697 a month. The median home price was up 19% over 12 months, and the downpayment was $161,000, up $25,400 in a year.

Ventura: $2,887 payment on the record $775,000 median. That payment is 10% below the all-time high. The loan payment was up 32% in a year or $646 a month. The median price was up 18% over 12 months, and the downpayment was $155,000, up $23,100 in a year.

Bottom line

Rarely have prices and rates put pressure more swiftly on house hunters.

Ponder these soaring costs in a historical context. Regionally, the year’s estimated house payment jump tops 96% of all 12-month periods since 1988.

And by county? Los Angeles (93%), Orange (96%), Riverside (96%), San Bernardino (92%), San Diego (95%), and Ventura (94%).

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com