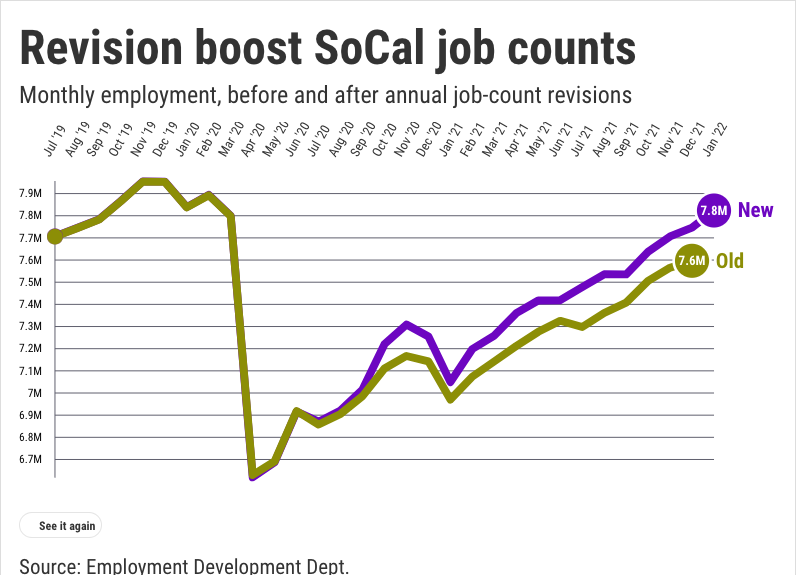

Southern California’s pandemic-recovery hiring spree was 66% bigger than previously estimated, new jobs data shows.

The four-county region averaged 7.44 million jobs throughout 2021’s economic reopening, according to data revisions released Friday, March 11. That was 134,000 more jobs than previously reported. The revisions also found an extra 34,000 jobs in 2020.

That means 2021’s growth topped 2020 by 249,500 jobs, including 100,000 more workers — or 66% more than preliminary estimates.

One of the less-discussed truths about economic data is that monthly estimates are almost always less accurate than the more sophisticated analyses performed over longer periods. Employment stats are a perfect example.

The widely watched monthly jobs numbers from the state Employment Development Department and the U.S. Bureau of Labor Statistics come from surveys of businesses and households. But once a year the government’s data crunchers revise their math, largely based on a review of unemployment insurance records. This paperwork connects the dots on almost every worker in the nation.

So, what we think we know vs. what’s actually happening can take time to percolate to the surface. And California’s faster-than-first-reported hiring pace is yet another piece in the pandemic’s economic puzzle that includes a worker shortage, soaring home prices, ballooning inflation and crowded freeways.

And while the revised stats for 2021 and 2020 offer some good news, let’s not forget that last year’s regional employment was still 345,000 jobs short of the good ol’ days of 2019 when few knew the misery of a pandemic.

IE hiring wins

The revised data shows the Inland Empire is leading the region’s hiring rebound. That’s not terribly surprising since it’s a hub for one of the hottest business trends — logistics.

Riverside and San Bernardino counties averaged 1.57 million jobs last year, up 73,900. That’s an additional 33,000 jobs — or 45% more hirings than previously reported. In 2020, the counties lost 57,600 jobs — 6,700 fewer than the previous estimate. By this math, the two-county region is 16,300 jobs ahead of pre-pandemic days.

Los Angeles County had 4.3 million jobs last year, up 128,000. That’s an additional 65,100 jobs or 51% more hirings than previously reported. In 2020, the county lost 394,400 jobs — 20,400 fewer than previous estimates. It adds up to 266,400 fewer jobs than before coronavirus.

Orange County had 1.58 million jobs last year, up 47,600 with an additional 1,500 jobs or 3% more hirings than previously estimated. In 2020, the county lost 142,600 jobs — 6,100 fewer than previous estimates. Orange County remains 95,000 workers short of its pre-COVID-19 numbers.

Still, less fun

Another split in the region is how employment has varied by industry in the pandemic era.

The “fun” industries — hospitality trades serving food, entertainment and tourists — have slowly regained what was lost when the virus made large gatherings unpopular.

These businesses averaged 767,200 jobs in the region in 2021, up 70,700. That’s 12,100 more hirings than previously reported. Last year followed a horrific 2020 when 254,200 jobs were lost — 1,400 fewer than previous estimates.

The rest of the economy had 6.68 million jobs last year, up 178,900 for 2021, and 87,600 more hirings than previously estimated. In 2020, 340,400 jobs were lost — 31,800 fewer than previous estimates.

Related Articles

California unemployment rate holds amid inflation worries

America had a record 11.3 million jobs available in January

Stocks tumble as war overshadows ‘fantastic’ US jobs data

US added 678,000 jobs in February in sign of economic health

Californians going back to the office soon? Investors don’t think so

Hospitality trades suffered disproportionally large jobs cuts. Since 2019, the “fun” industries are down 183,600 workers. That’s slightly more than half of the region’s employment drop in the pandemic era.

Yet the leisure and hospitality industries are relatively small, accounting for only 10% of all local jobs.

Who’s hiring?

The bottom line for job seekers isn’t found in these long-term hiring trends, rather it’s which bosses are beefing up staff.

So here’s a look at key employment niches ranked by how many jobs were added in 2021 — or cut — vs. a lot of cuts in 2020 …

Restaurants: Up 56,420 last year to 583,860 jobs vs. cutting 154,680 workers in 2020.

Business services: Up 53,850 last year to 1.12 million jobs vs. cutting 69,060 workers in 2020.

Retailing: Up 35,860 last year to 722,650 jobs vs. cutting 62,280 workers in 2020.

Transportation/warehouses: Up 33,660 last year to 423,908 jobs vs. adding 20,820 workers in 2020.

Healthcare, personal services: Up 30,180 last year to 1.16 million jobs vs. cutting 12,780 workers in 2020.

Arts, entertainment and recreation: Up 14,720 last year to 123,280 jobs vs. cutting 64,680 workers in 2020.

Construction, real estate, finance: Up 8,980 last year to 652,750 jobs vs. cutting 21,350 workers in 2020.

Hotels: Down 480 last year to 60,070 jobs vs. cutting 34,880 workers in 2020.

Manufacturing: Down 5,730 last year to 553,630 jobs vs. cutting 41,700 workers in 2020.

Government: Down 17,200 last year to 957,120 jobs vs. cutting 36,330 workers in 2020.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com