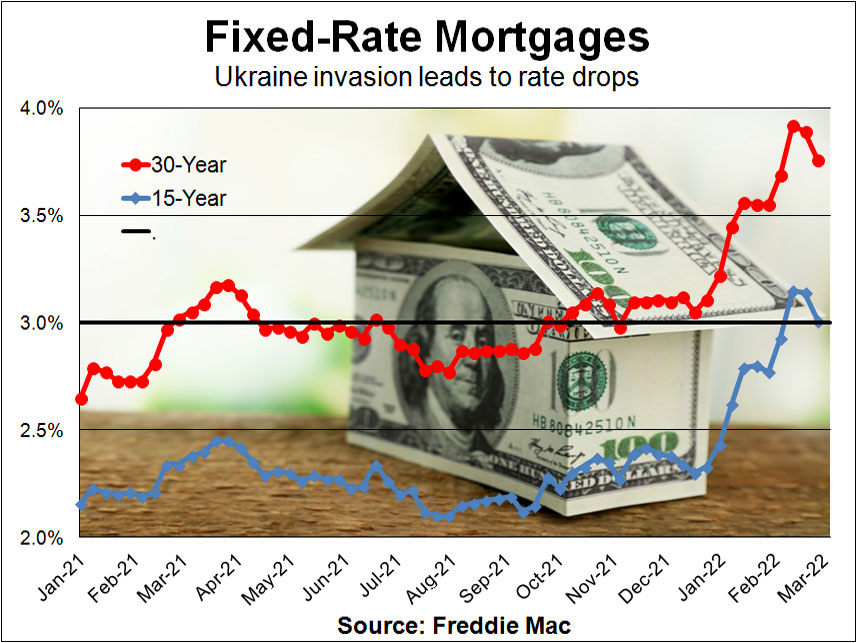

Russia’s invasion of Ukraine is giving us a mortgage rate reprieve.

Freddie Mac mortgage rates dropped 16 basis points in the past two weeks, averaging 3.76% for a 30-year fixed this week. We haven’t seen rates drop that much in a two-week period since July 2021.

In times of crisis, there is a flight to financial safety. Money floods into the haven of the U.S. Treasury market and mortgage-backed securities. More money flooding the markets means lower mortgage rates. At least for now.

“We will continue to assess the potential impact on mortgage demand,” said Joel Kan, vice president of economic & industry forecasting at the Mortgage Bankers Association. “The conflict in Ukraine will pull rates lower, at least briefly.”

The MBA has forecast the 30-year fixed rate will be 4.3% by the end of the year.

The Federal Reserve is in a precarious place. The U.S. was already facing daunting inflationary pressures. The invasion has made this worse, especially for energy costs. For example, this week oil prices briefly hit $115 per barrel. That is a 15% spike since oil already landed at the $100 a barrel milestone on Feb. 23.

Fed Chairman Jerome Powell testified on Capitol Hill Wednesday, March 2, the Fed will increase short-term rates one-quarter point this month, not one-half point as many Fed watchers were expecting.

Even so, economists I’ve interviewed are not changing their housing and interest rate forecasts unless this becomes a prolonged war.

“The Federal Reserve is squeezed between two things — inflation and the disruption in the international economy,” said Raymond Sfeir, director of Anderson Center for Economics Research at Chapman University.

Sfeir still sees the 30-year fixed mortgage hitting 4.5% by the end of 2022. He expects statewide median home prices to drop 2.5% in the fourth quarter. Less affordable Orange County will fare a little worse, in his view, with a 3.3% home price drop. The silver lining is Sfeir sees median prices moving up 3% in the more affordable Inland Empire.

Mark Zandi, chief economist at Moody’s Analytics, also sees mortgage rates at 4.5% by year’s end and U.S. median home prices flat. He advises waiting to purchase.

“I would not be in a rush to buy now. Wait a bit,” he said. “The market is easing. Inventory is the key. More homes available gives you more choices.”

“It’s kind of a mixed bag with more inflationary pressures, more supply chain disruptions and the disruption of the financial markets,” added Jordan Levine, chief economist at the California Association of Realtors. He predicted California’s median price will increase 5.2%, although that’s a steep drop from 2021’s 19.3% price spike.

“No drastic forecasting revisions yet,” he said. “I still think it’s a good time to get into the market.”

Brad Seibel, head of mortgage lending at digital mortgage lender Sage, believes home shoppers need to act quickly to lock in lower mortgage rates.

“This window of opportunity can be short-lived,” Seibel said.

Most economists agreed a prolonged war is possible. Does a prolonged war mean a worldwide recession?

The U.S. doesn’t do a lot of direct business with Russia and doesn’t on Russia for oil and natural gas. A recession is more likely to hit Europe, experts say.

What about a Russia invasion beyond Ukraine?

If Russia extends its invasion beyond Ukraine, into Moldova or Poland, for example, the damage to the global economy would be severe and recession would be unavoidable, Zandi wrote in a Feb. 28 commentary. Did you catch that? Unavoidable.

Zandi told me he thinks there’s a 10 to 20% chance of this happening. He also said oil prices could spike to $150 per barrel if Russia curtails oil and natural gas exports.

Freddie Mac rate news: The 30-year fixed rate averaged 3.76%, 13 basis points lower than last week. The 15-year fixed rate averaged 3.01%, also 13 basis points lower than last week.

The Mortgage Bankers Association reported a less than 1% decrease in mortgage application volume from the previous week.

Bottom line: Assuming a borrower gets the average 30-year fixed rate on a conforming $647,200 loan, last year’s payment was $265 less than this week’s payment of $3,001.

What I see: Locally, well-qualified borrowers can get the following fixed-rate mortgages without points: A 30-year FHA at 3.25%, a 15-year conventional at 3.125%, a 30-year conventional at 3.75%, a 15-year conventional high-balance ($647,201 to $970,800) at 3.125%, a 30-year conventional high-balance at 4.25% and a 30-year fixed jumbo purchase loan at 3.75 %.

Eye-catcher loan of the week: A 30-year purchase, adjustable jumbo mortgage, locked for the first 10-years with an interest-only payment at 3.125% without points.

Jeff Lazerson is a mortgage broker. He can be reached at 949-334-2424 or jlazerson@mortgagegrader.com. His website is www.mortgagegrader.com.

Related Articles

Mortgage outlook: Rates could keep climbing

How to safely tap home equity in a financial emergency

Condo questionnaire causing some boards to boycott Fannie, Freddie financing

Mortgage rates slip to 3.89% as Russian aggressions spook investors

Californians 35% less likely to qualify for starter home than US house hunter