“Bubble Watch” digs into trends that may indicate economic and/or housing market troubles ahead.

Buzz: As house hunters grapple with record-high home prices another financial blow hits — a sudden rise in mortgage rates pushed the average 30-year rate to 4.42% this week. It’s a stunning jump that harks back to the sharp loss in borrowing power during the infamous rate spike of 1980.

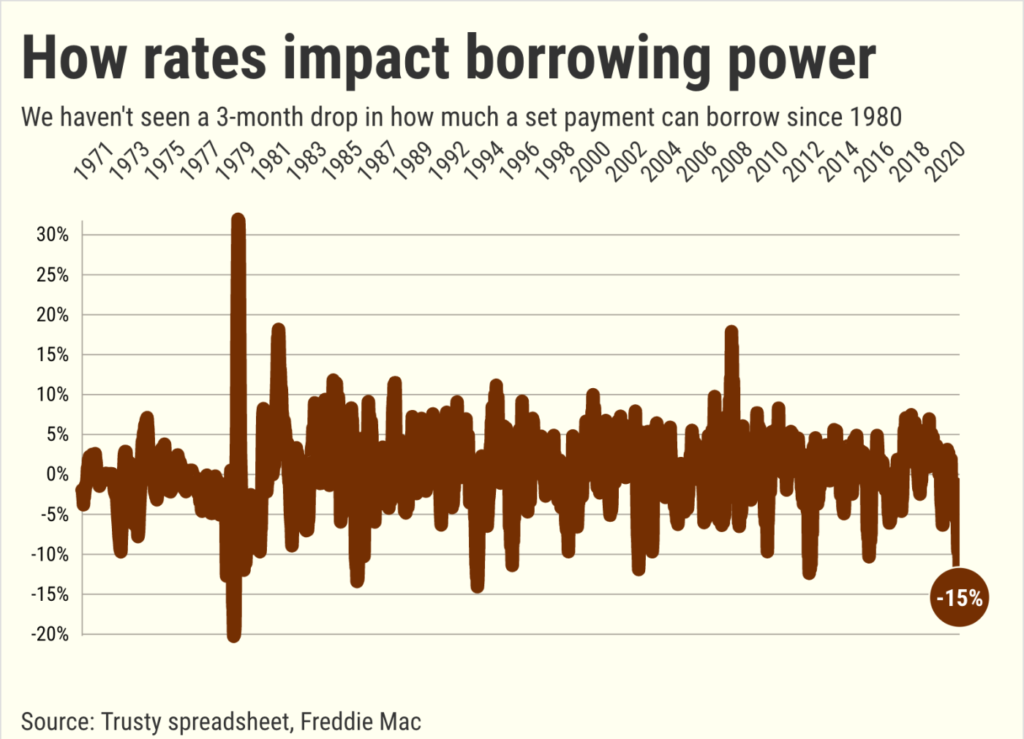

Source: My trusty spreadsheet looked at 51 years of Freddie Mac’s weekly average rates and how those rate changes translated to what really matters in housing — how much a house hunter can borrow.

The Trend

This week’s rate was up 0.26 percentage points from 4.16% on March 17 and was the highest since January 2019.

Now before you say, “quarter-point, that’s not so bad,” consider what that means to a potential borrower who can pay $2,500 a month for a mortgage. This week, the bank would lend $498,000 for that payment at these rates — that’s down $15,600 or 3% in just seven days.

Outside of the previous week’s 3.7% drop in borrowing power, this was the worst week for mortgage shoppers since 2016 and the 20th-largest drop since 1971.

By the way, the top drop was the week of March 14, 1980. That’s when rates went from 14% to 15.4% creating an 8.6% drop in borrowing power.

Remember that with rates bumping up off historic lows, increases of a fraction of a percent can be as financially painful as jumps of multiple percentage points in the era of double-digit mortgage rates.

The Dissection

The Federal Reserve promised a moderate upswing in rates for 2022.

It was a bet by everyone from the Fed chairman to numerous rate gurus to industry cheerleaders that the central bank would smoothly prune its housing bailout — a complex, cheap money policy used to prop up the economy amid coronavirus uncertainty. The Fed wanted to slowly nudge rates higher in an attempt to cool the overheated economy’s inflation problem.

Related Articles

Bubble watch: Southern California home prices break $700,000 barrier in 15 months

Bubble watch: California doubles housing demands to 2.5 million by 2030

Is $5 gasoline the new normal? It’s 14 years in the making

Bubble watch: Will Ukraine conflict shatter California’s optimism?

But inflation proved worse than already feared, hitting levels last seen in those crazy early-1980s. And this year’s Russia-Ukraine conflict upset energy and financial markets, too.

Thus, housing in 2022 must digest the unexpected.

So, think back three months to the holiday season. Just 13 weeks ago the Freddie Mac average hit its most-recent low of 3.05%. Now we are up 1.37 percentage points since the days right before Christmas.

Do not forget, for the house hunter using a mortgage, this rate surge is a shocking slash to how much house they can buy.

My borrowing-power metric clearly shows the house hunter’s pain from what might seem like a modest rate blip. That hypothetical $2,500 monthly payment today gets you a $91,000 smaller loan than what was available near 2021’s end — or a 15.5% drop in just three months.

That’s the eighth-largest three-month dip in the past half-century. The seven other huge declines came in that ugly spike four decades ago. The largest was during the three months ended April 4, 1980, a 20% loss of borrowing power as rates from 12.85% to 16.35%.

How bubbly?

On a scale of zero bubbles (no bubble here) to five bubbles (five-alarm warning) … SIX BUBBLES!

Tell me: Who can afford to buy now?

Remember, a house hunter today must deal with pricier mortgages AND record-high home prices. The Southern California median selling price for February hit an all-time high of $706,000 — up 15% in a year and 31% since the pandemic started.

Next, ponder the predicament of my home-seeking household that seeks a $2,500 monthly mortgage — not including property taxes or insurance costs. If I assume that payment is one-third of their paycheck, it’s a family with a roughly $90,000 income.

Basically, the last 13 weeks of soaring mortgage rates cut borrowing power by $91,000 — roughly what that household earns in a year.

These housing shoppers better have (1) rich relatives or (2) investment profits or (3) just got a huge raise. If not, they face having far less money for house shopping or must take extra financial risks to get a home purchased.

None of this is good for the health of the housing market.

Jonathan Lansner is business columnist for the Southern California News Group. He can be reached at jlansner@scng.com