“Bubble Watch” digs into trends that may indicate economic and/or housing market troubles ahead.

Buzz: State regulators say California’s housing needs have doubled and ordered 2.5 million more residences to be built by 2030 — a pace that’s roughly what Texas and Florida built combined in the last six years.

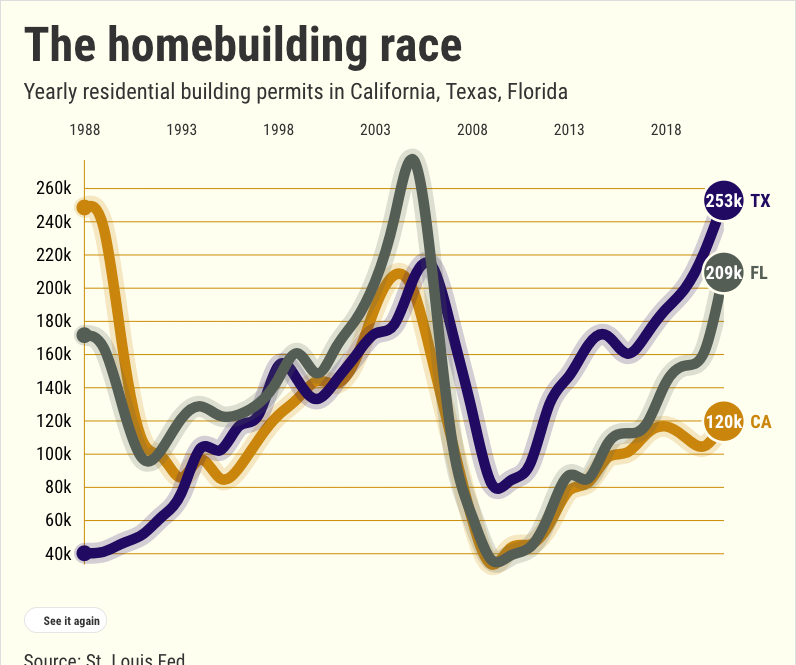

Source: My trusty spreadsheet reviewed federal stats on building permits and population for California, the state’s economic rivals of Texas and Florida, and what was done elsewhere in the U.S. This data dates back to 1988, the days of the last great building boom, which left numerous developers stuck with gobs of unsold new homes.

The Trend

Build it and they will come?

Roughly speaking, California’s revised housing plans demand cities permit home construction at a pace of roughly 300,000 a year.

That’s triple the state’s average pace in the past six years. The last time California construction came anywhere close was the soon-to-bust years of 1988 and 1989.

And it’s huge even for what I’ll call “Tex-orida,” which issued a combined 2.4 million residential building permits in the past six years.

Plus, when population growth — or the lack of — is factored in, California is already building homes at a residences-to-residents pace six times what was done in 1988 through 2015.

The Dissection

How many more homes does California really need?

Population growth is one key driver in housing demand. And we all know that California’s people count is now all but stagnant. Chilled population growth is a nationwide trend, too.

The state’s up 333,540 residents between 2016 and 2021 — just 3% of all U.S. growth. That adds up to annual average population growth of 55,590 — 86% below California’s yearly growth pace between 1988 and 2015.

Tex-orida? 3.6 million more residents — 36% of U.S. growth — or 603,572 annual average. That’s 13% below 1988-2015.

Elsewhere — 47 states and D.C. — gained 6.1 million more residents or 61% of U.S. growth. The 1 million-a-year growth rate is 42% below the 1988-2015 pace.

Next, ponder permitting patterns to see if new supply in the works is meeting the meek growth in potential customers — whether that is buyers or renters.

California granted 662,844 permits in 2016-21 — that’s 8% of U.S. residential construction plans, more than double the share of population growth. It’s a 110,474 annual average for a planning pace 8% below of the 1988-2015 pace.

Tex-orida is hot for homebuilding. Its 2.1 million units permitted — 25% of U.S. — was a 348,149 annual average that’s 38% above 1988-2015.

But there’s not as much enthusiasm elsewhere: 5.6 million permits — 67% of U.S. — or 940,836 annual average. That’s 1% below the previous 28 years.

How bubbly?

On a scale of zero bubbles (no bubble here) to five bubbles (five-alarm warning) … FIVE BUBBLES for the state plan but THREE BUBBLES for reality.

When the pace of construction exceeds population changes — even if they’re both falling — you have a big question to ask: Will more homes boost population growth or homeownership levels.

California? 199 units per 100 new residents. That’s 539% above 1988-2015. Yes, six-fold-plus jump.

Tex-orida? 58 per 100. That’s 58% above 1988-2015.

Related Articles

Is $5 gasoline the new normal? It’s 14 years in the making

Bubble watch: Will Ukraine conflict shatter California’s optimism?

Bubble watch: Biggest Southern California rent spike in 37 years?

Elsewhere? 92 per 100. That’s 71% above 1988-2015.

So are we building to help current residents — or as a tactic to lure folks from elsewhere?

And I think overly optimistic building quotas only juice up the anti-development groups and set up pro-growth forces for eventual disappointment.

Yes, California home prices and rents have soared. But historically low interest rates and generous tax breaks for owners are as much a part of the pricing inequality as is limited construction.

California can also boost its supply challenges with other bold moves such as questioning how to slow what’s become a quasi-hoarding of homes. Buyers, including institutional investors, have been scooping up homes for short-term rentals, single-family home rentals, second homes and vacation properties.

And, remember, part of the recent homebuying fervor can be tied to a short-term surge in young adults entering household-formation ages. That does not change the demographic reality: This is an aging state and nation.

Disappearing population growth will challenge many slices of the economy in most of this nation in the coming decades.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com