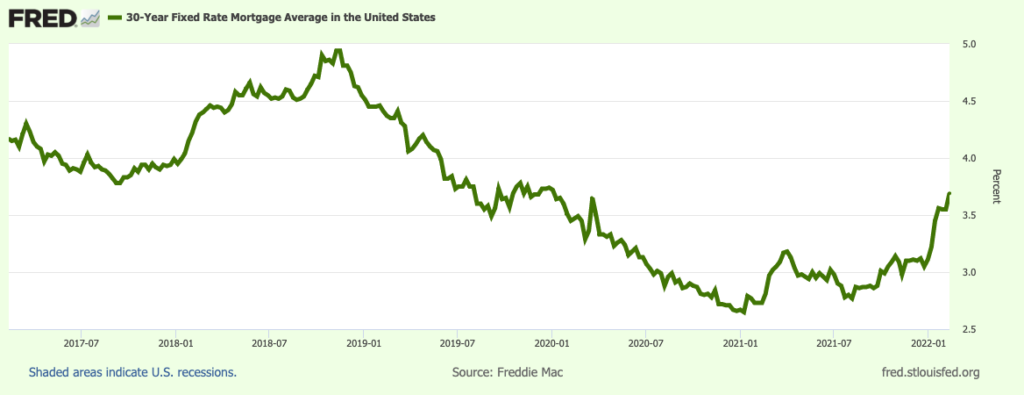

Mortgage rates soared again this week, approaching levels not seen since 2019.

The average rate on a 30-year loan reached 3.92%, up from 3.69% the previous week, mortgage buyer Freddie Mac reported Thursday. A year ago, the long-term rate was 2.81%.

The last time the 30-year rate was higher was in May of 2019 when it reached 3.99%.

The average rate on 15-year, fixed-rate mortgages, popular among those refinancing their homes, rose to 3.15% from 2.93% one week earlier. It stood at 2.21% a year ago. It last breached 3% in March of 2020, just at the pandemic was breaking in the U.S.

Q. What’s up?

A. The Federal Reserve has signaled that it would begin the first in a series of interest rate hikes in March, reversing pandemic-era policies that have fueled hiring and growth but also contributing to inflation levels not seen since the early 1980s.

The Labor Department reported last week that consumer prices jumped 7.5% last month compared with 12 months earlier, the steepest year-over-year increase since February 1982. Higher costs for nearly everything have burdened consumers, offsetting pay raises and reinforcing the Federal Reserve’s decision to begin raising borrowing rates across the economy.

The home-loan surge follows the recent rise in Treasury yields, which have moved higher due to inflationary pressures and market expectations of more aggressive policy moves by the Federal Reserve, said Joel Kan, the Mortgage Bankers Association’s associate vice president of economic and industry forecasting.

Q. What does it mean for housing?

A. The price for a new home has jumped about 14% in the past year and as much as 30% in some cities. Housing has been in short supply even before the pandemic, and higher prices and rising interest rates will make it even harder for homebuyers.

“As rates and house prices rise, affordability has become a substantial hurdle for potential homebuyers, especially as inflation threatens to place a strain on consumer budgets,” said Sam Khater, Freddie Mac’s chief economist.

Mortgage rates’ rise means refinancing benefits fewer homeowners. As a result, the share of applications that were refinances was at its lowest level since July 2019, Kan said, adding that refinance applications fell 9% last week and stood at around half of last year’s pace.

Applications for mortgages to purchase a home also saw a decline over the week, Kan said.

“Prospective buyers still face elevated sales prices in addition to higher mortgage rates,” Kan said. The mix of more conventional loans has pushed the average loan size to yet another record of $453,000, he noted.

Q. Who can buy?

A. Rising home prices combined with limited inventory have created a one-two-punch for buyers, with fewer homes affordable to buyers based on their income level, said Danielle Hale, Realtor.com’s chief economist.

That was the case even before mortgage rate increases, which have upped the monthly cost of the typical $375,000 home listing by roughly $115 since December, she said.

“Looking ahead, we expect rising incomes to help home shoppers navigate rising housing costs, but buyers will also likely have to make compromises to be successful,” said Hale.

Bloomberg, Associated Press, CNN and the Southern California News Group’s Jonathan Lansner contributed to this report.