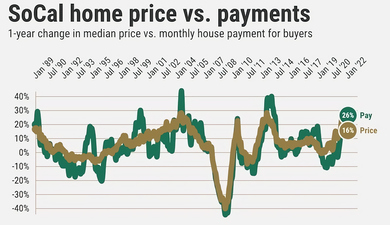

“Payment Pain” deals with the seemingly forgotten and heart-wrenching reality of Southern California homebuying finances — it’s really about the size of the monthly check to the lender, not the sales price.

Buzz: It’s been one year since mortgage rates hit their historic low. January’s local homebuyers first had to digest prices: The median home price was up 15% in 12 months. And then because of rising rates, borrowers saw the monthly payment on that median balloon 26% from January 2021.

Source: My trusty spreadsheet looked at what’s become a blood-boiling mix: the intersection of higher home prices (monthly median from DQNews) and rising mortgage rates (average 30-year deals from Freddie Mac). We’re using a hypothetical monthly home-loan payment with a 20% downpayment.

Rate watch: January’s borrowers could get an average 3.45% rate for a 30-year mortgage vs. 3.1% a month earlier and 2.74% in January 2021 when the 30-year average hit an all-time low. Oh, and my math does not include the latest news — rates hitting 3.92% on Feb. 17, highest since May 2019.

Pay to the order of

The hypothetical buyer using a traditional home loan got an estimated house payment of $2,453 in January on the $687,000 median-priced home at current rates.

That’s up 3.3% in a month and 26% pricier than January 2021. It’s also 6% below the record $2,606 payment set in July 2007.

By the way, the January median price by itself was down 1.2% for the month but up 15% in a year.

Locally speaking

Let’s look at similar math for January home payments found in the counties covered by the Southern California News Group …

Orange: Record-high $3,392 payment on $950,000 median. January payment is up 6.2% in a month; up 30% in a year. Median alone? Up 1.6% for the month; up 19% in year.

Los Angeles: Buyers got a $2,824 payment on the countywide $791,000 median, just below the record $2,825 set in July 2007. January’s payment is up 2.7% in a month and up 25% in a year. Median price alone? Down 1.7% in month and up 15% in year.

Related Articles

Q&A: What do 3.92% mortgage rates, highest in 33 months, mean?

Asian stocks follow Wall St up after Fed inflation comments

Fed: Faster rate hikes are likely if inflation stays high

US inflation highest in 40 years, with no letup in sight

Local inflation soars: Inland Empire hits 8.6%, LA-Orange counties, 7.5%

Riverside: $1,964 payment on $550,000 median is 10% below the record $2,190 set in June 2006. January payment is up 4.5% in a month; up 32% in a year. Median alone? Flat for the month; up 20% in a year.

San Bernardino: $1,696 payment on $475,000 median is 11% below the record $1,904 set in July 2006. January payment is up 2.2% in a month; up 28% in a year. Median alone? Down -2.2% for the month; up 17% in a year.

Bottom line

When pondering SoCal payment jumps in a historical context (going back 34 years), you’ll see these are rare times as prices typically have defied the added costs of rising rates.

The six-county region’s moonshot in this home-financing cost metric — that’s January vs. one year earlier — exceeds 95% of all 12-month periods since 1988. By county? Los Angeles, 94%; Orange, 96%; Riverside, 96%; and San Bernardino, 92%.

Caveat

Industry cheerleaders will say “but rates are still historically low!” Yes, January’s 30-year rates were 31% below this century’s 4.99% average rate.

The “but” … SoCal’s median price is 73% higher than its $396,939 average for the same period. So today’s house payments are 47% above the 21st century’s $1,666 average.

And don’t forget the latest average rate of 3.92% vs. January’s 3.45% used in this math!

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com