At the end of January, a federal judge refused to stop the San Bernardino County Sherriff from seizing cash from state-licensed cannabis dispensaries. While conflicting state and federal laws and perverse incentives may have caused this headache, new payment technologies could help alleviate some of the pain.

Since November 2021, the San Bernardino County Sheriff’s Department has seized nearly $1.1 million from marijuana dispensaries, targeting armored vehicles transporting dispensaries’ cash to safer locations. The Sheriff Deputies pulled the vehicles over, alleging minor traffic violations, seized the cash, and then turned the funds over to the Federal Bureau of Investigation. The FBI, in turn, claimed the cash was tied to drug or money laundering operations but made no arrests.

Like the recent raid on U.S. Private Vaults Inc. in Beverly Hills, the story highlights an alarming trend in civil asset forfeiture abuse. Local law enforcement is incentivized by a profit-sharing structure that allows them to retain up to 80% of the cash seized.

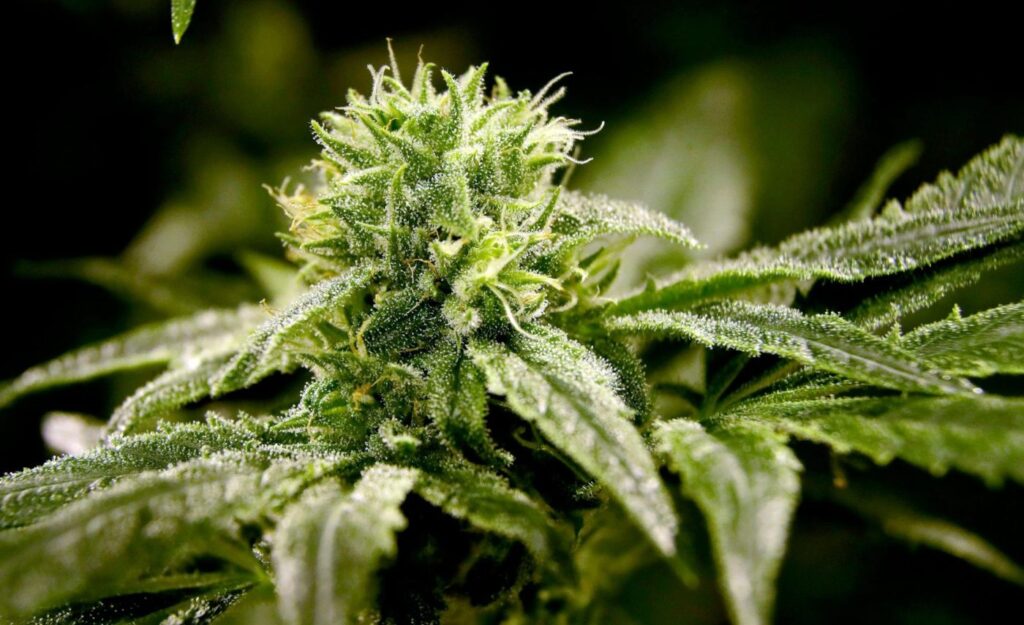

While 36 states have legalized medical cannabis, and 18 states legalized recreational cannabis, the federal government has resisted legalization. The U.S. Drug Enforcement Agency classifies cannabis as a “schedule I” controlled substance, making it illegal under federal law to possess, sell, or manufacture marijuana products. Since most banks and other financial institutions are chartered by the federal government, the majority either refuse or are very hesitant to work with cannabis businesses.

This has forced a $17.5 billion industry to operate almost entirely cash-only. The unfortunate consequence is that dispensary employees have become victims of violent armed robberies. In response, business owners have hired private security to protect their storefronts and transport their profits.

Still, the cannabis industry is in critical need of a viable, cashless system to meaningfully enhance efficacy, increase safety, and minimize government harassment. Fortunately, an option which doesn’t require federal legalization is already available.

Enter cryptocurrencies. In some respects, they function the same way as physical money issued by a government, as people can use them to purchase goods or services. In other ways, cryptocurrencies are unique. A government’s economic weight is behind government-issued currencies. But with cryptocurrencies, a limited supply or the value people place on the product determines its worth.

Cryptocurrencies are based in a technology called blockchain. While an over-simplification, picture a spreadsheet that records every transaction, even down to the most minute, partial one. That spreadsheet does not appear on just one computer, but is spread across hundreds of thousands, if not millions, of computers. And each computer is responsible for validating the accuracy of the spreadsheet, including the most recent transactions.

Related Articles

California’s ludicrously late financial report

Voters send clear message to the San Francisco school board

Honoring the irreplaceable P.J. O’Rourke

We can’t defend Ukraine and Taiwan

Why experts should embrace humility after their inflation miscalculation

With digital currency, people don’t need to carry cash around with them. Instead, they can convert funds into cryptocurrencies through digital wallets. Many of these digital wallets, in turn, can be found on mobile devices.

Several dispensaries already accept Bitcoin and other cryptocurrencies along with cash. If more dispensaries accepted cryptocurrencies and encouraged their customers to pay with them, those dispensaries would have less cash on hand. With less cash on hand, both individuals and their money would be more secure.

Innovative technologies can offer solutions to many problems people face today. Where law enforcement may have an incentive to seize cash in bad faith or where banks may feel like they cannot act, technologies can help avoid the problem by providing options for cashless transactions. As state and federal government policies collide and inevitably create hurdles, innovators will always look for ways to offer solutions.

Nino Marchese is the director of the Criminal Justice Task Force at the American Legislative Exchange Council (ALEC). Jonathon Hauenschild is the director of the Communications and Technology Task Force at ALEC.