“Payment Pain” deals with the harsh reality of Southern California homebuying finances — it’s really about the size of the monthly check to the lender, not the sales price.

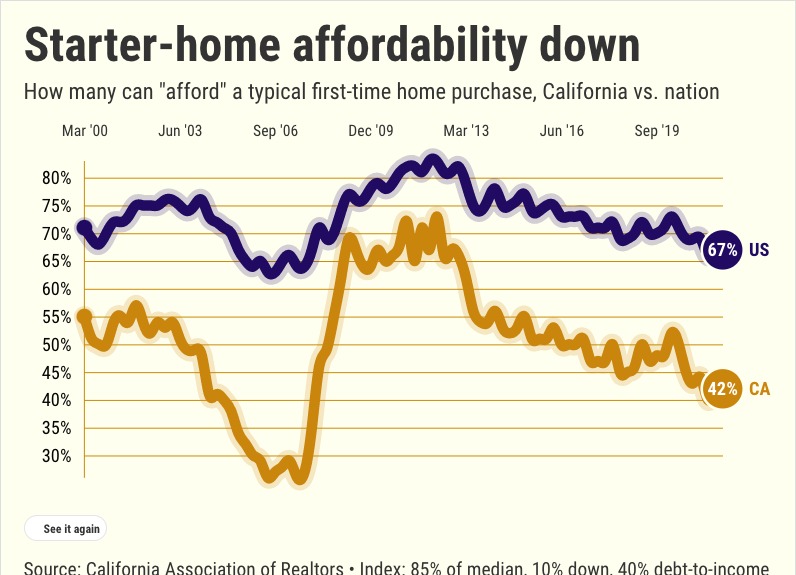

Buzz: A Californian is 35% less likely to qualify to buy a starter home than a typical U.S. first-time house hunter.

Source: My trusty spreadsheet looked at the California Association of Realtor’s first-time buyer “affordability” benchmarks — state vs. national — to study the financial push for home seekers to look outside of the state.

Pay to the order of

At year’s end in California, a $96,000 income was needed to afford the $3,200 payment on a median-priced $677,850 starter house. That translates to a 44% affordability rate for Californians as 2022 started vs. 52% in the pre-pandemic months of 2020’s first quarter.

Nationally, a buyer needed a $43,500 income to afford the $1,450 payment on a median $307,450 starter house. Affordability was 67% vs. 73% in 2020’s first quarter.

Now ponder the growing gap between these measures of homebuying finance-ability. A Californian was 35% less likely to have the income needed to buy vs. a typical U.S. buyer at year’s end. In 2020’s first quarter, before business limitations rocked the economy and the housing market, the gap was just 29%.

Locally speaking

Let’s look at similar math for fourth-quarter home payments found in the four counties covered by the Southern California News Group …

Los Angeles: $96,000 income needed to afford a $3,200 payment on a median $678,210 starter house. That’s 39% affordability, off from 47% in pre-pandemic days.

Related Articles

More student, faculty housing ahead for California colleges?

Buying is more affordable than renting in these cities

Black homeownership drops in pandemic era, by this math

Bubble watch: Biggest Southern California rent spike in 37 years?

How a tiny-home movement is putting more than just a roof over the homeless

Orange: $138,300 income needed to afford the $4,610 payment on a median $977,500 starter house. That’s 34% affordability down from 41% pre-pandemic.

Riverside: $70,500 income needed to afford the $2,350 payment on a median $497,250 starter house. That’s 51% affordability down from 60% pre-pandemic.

San Bernardino: $54,300 income needed to afford the $1,810 payment on a median $382,500 starter house. That’s 61% affordability down 69% pre-pandemic.

Caveat

No two house hunters are alike. This less-than-traditional metric estimates a typical first-timer’s challenges by being more generous in qualification terms than most affordability benchmarks. For example, it assumes a house hunter earns the median household income and is buying a residence worth 85% of the median sales price, financed with 10% down. Payments, insurance and taxes all eat up 40% of household income.

Bottom line

Let’s look at affordability changes — state vs. nation — as a yardstick of how much push exists is for rookie house hunters to seek ownership outside the Golden State.

Year end’s 35% affordability gap is a larger nudge to leave California for cheaper housing than what existed in 2013-2019 (an average 31% gap) as housing recovered from the Great Recession’s wrath.

Yet it’s also not the 40% gap of the “bubblish” era of 2000-2007.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com