“Bubble Watch” digs into trends that may indicate economic and/or housing market troubles ahead.

Buzz: The surprising Orange County housing market last year had 18% more sales despite 10% higher house payments compared to pandemic-iced 2020.

Source: My trusty spreadsheet used a longer-view lens to analyze 12-month periods of homebuying stats from DQNews dating to 1988.

The Trend

Despite plenty of pandemic challenges, including limited inventory in a choppy economy, 3,426 purchases closed last year, the No. 12 busiest year since 1988. Transactions were up 18% vs. 2020, the third-biggest jump in 34 years. It was only 0.1% below the 1988-2020 sales average, which is impressive considering how historically slow buying had been since the Great Recession.

The Dissection

Record-breaking prices in didn’t throttle Orange County homebuying. Last year’s $882,583 average monthly median, an all-time high — was up 14% vs. 2020, the No. 7 biggest jump in 34 years. Note that prices have increased at a 4.8% annual rate since 1988.

Cheap financing was key, with mortgage rates averaging 2.96% in 2021 (the lowest on record) vs. 3.11% in 2020, the second-lowest in history. Note: Mortgage rates have begun 2022 on a noteworthy upswing.

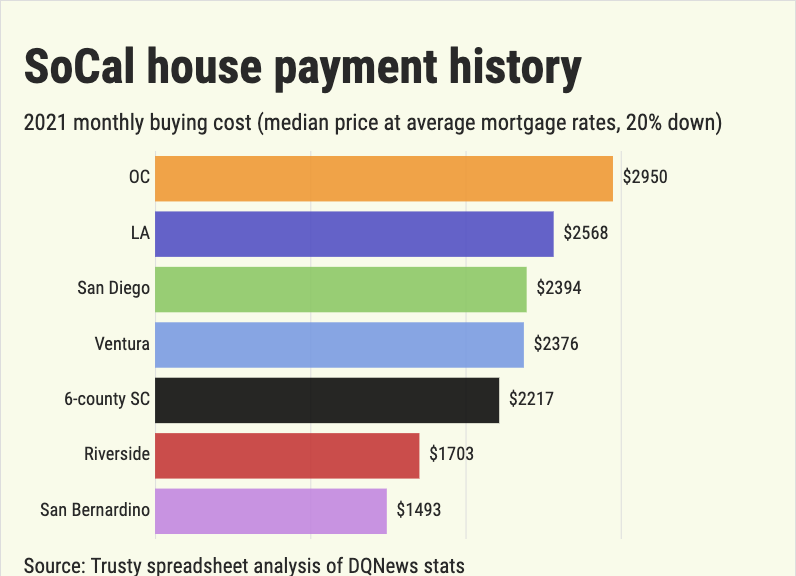

Now, look at what that buying power and surging prices meant to a typical buyer: The average purchase in 2021 came with an estimated monthly payment of $2,950 — median-priced home at average rates, 20% down — the third-highest since ’88. That is up 10% vs. 2020, the No. 12 biggest jump. Compare that to payments increasing 2.4% annual rate since 1988.

Another factor

Orange County builders added a modest amount to house hunters’ choices, selling 2,798 residences last year (sixth slowest production). Yes, it’s up 10% vs. 2020, the No. 12 biggest jump in 34 years. Still, construction ran 49.2% below the 1988-2020 average.

New homes were 6.8% of all sales last year (third-lowest in 34 years) vs. an average share of 13.2% since 1988.

How bubbly?

On a scale of zero bubbles (no bubble here) to five bubbles (five-alarm warning) … FOUR BUBBLES!

Is this bit of housing history remarkable or really unnerving? In the brief pandemic era — historically, not mentally — 12 Orange County price records have been broken. So, 13% of the 96 new highs hit in a month since 1988 occurred in the past 22 months.

Jonathan Lansner is business columnist for the Southern California News Group. He can be reached at jlansner@scng.com