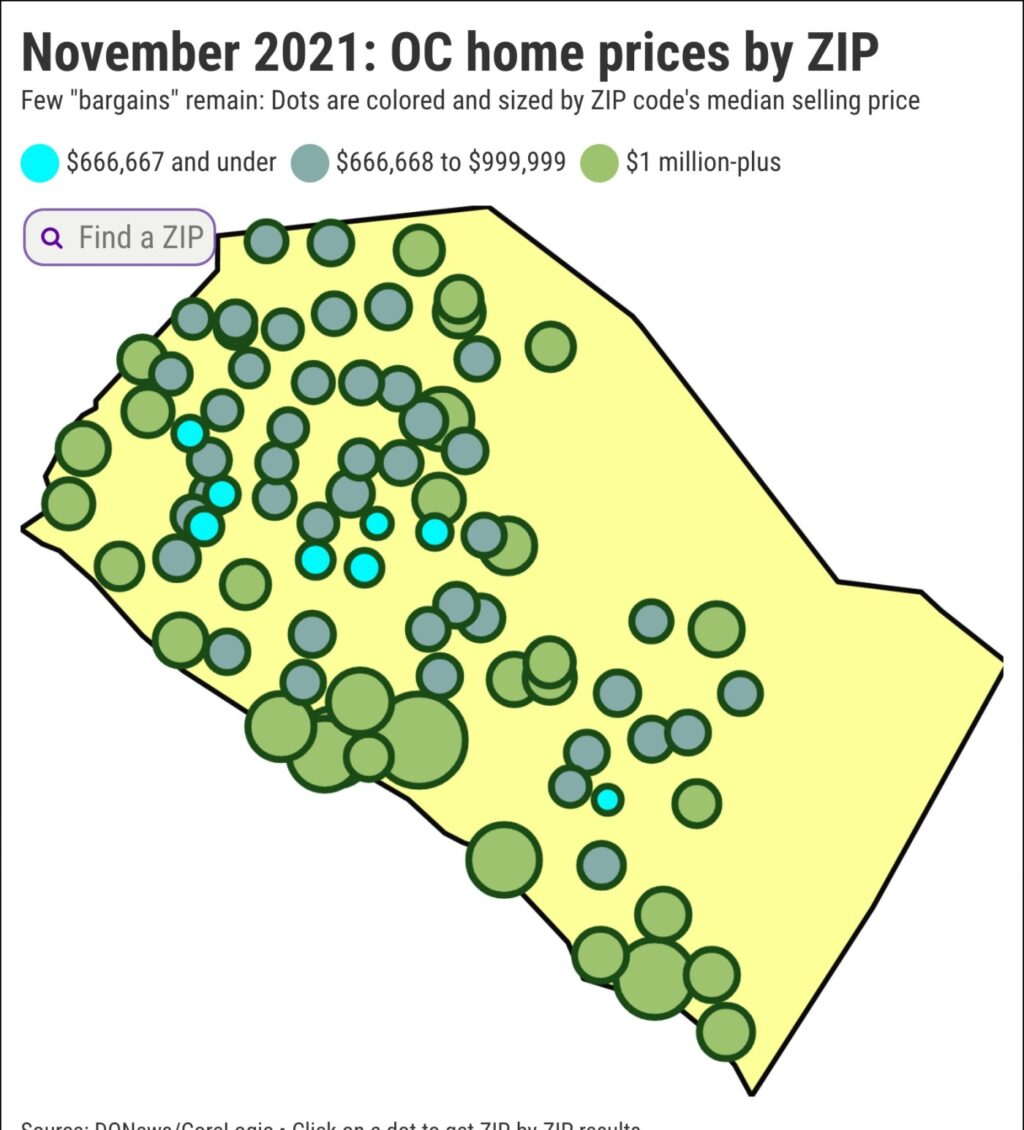

The pandemic’s homebuying binge has boosted the number of million-dollar Orange County neighborhoods by 12 in a year and 18 over 24 months — as the market lost 17 “affordable” communities in 12 months, leaving just a half dozen.

My trusty spreadsheet, filled with November homebuying stats from DQNews/CoreLogic for 83 Orange County ZIP codes, showed how home pricing has changed in the past two years. It categorizes “expensive” ZIPs as those with a median selling price of $1 million and higher and “affordable” neighborhoods as those with medians of $666,667 or less.

Yes, I agree that $666,667 is a lot of money. But at the start of 2017, $666,667 bought you a median-priced Orange County home.

Now, let’s look at the math …

November: The county had 32 seven-figure ZIPs with 1,269 sales or 40% of all purchases and only six “affordable” ZIPs with 191 sales or 6% of the market.

October: 31 seven-figure ZIPs with 1,220 sales or 37% of all purchases. Eight “affordable” ZIPs had 225 sales or 7% of the market.

November 2020: 20 million-dollar ZIPs with 677 transactions or 21% of all purchases; 23 “affordable” ZIPs had 744 sales, or 23% of the market.

November 2019: 14 seven-figure ZIPs with 417 closings or 15% of all deals; 27 sub-$666,667 ZIPs with 778 purchases, or 28% of all sales.

Why did this happen? Blame the homebuying feeding frenzy on low interest rates and a thirst for larger living spaces.

Those factors bumped the countywide median price to $919,000 for November — up 14.9% in one year. (That’s a $119,000 annual gain or $9,900 per month). In the previous 12 months, prices rose 8.2%, a $61,000 annual gain or a monthly uptick of $5,100.

This upswing is also widespread with medians increasing in 92% of local ZIPs in the past year and 71% in the previous 12-month period.

Let’s look at which ZIPs were in the million-dollar club for November and also the cheapest neighborhoods. Note that monthly sales data for individual ZIP codes can be volatile, so price trends may reflect a different mix of homes sold, not changing values. Data for 83 Orange County ZIPs can be found at bit.ly/novemberoc

New to the club

Here are the ZIPs new to the million-dollar club for November compared with a year ago, plus the median and year’s price change …

San Clemente 92672: $1.47 million — up 68%.

Yorba Linda 92886: $1.24 million — up 29%.

San Clemente 92673: $1.23 million — up 26%.

Trabuco/Coto 92679: $1.21 million — up 24%.

Costa Mesa 92626: $1.18 million — up 31%.

Huntington Beach 92646: $1.09 million — up 32%.

Tustin 92782: $1.07 million — up 24%.

Irvine 92606: $1.06 million — up 28%.

Costa Mesa 92627: $1.03 million — up 20%.

Ladera Ranch 92694: $1.03 million — up 22%.

Foothill Ranch 92610: $1.02 million — up 35%.

Fountain Valley 92708: $1 million — up 10%.

Orange 92869: $1 million — up 30%.

Returning ZIPs

Returning seven-figure club members … …

Newport Beach 92661: $4.51 million — up 84%.

Newport Coast 92657: $3.93 million — up 66%.

Newport Beach 92663: $3.26 million — up 147%.

Newport Beach 92662: $3.06 million — off 6%.

Corona del Mar 92625: $2.96 million — up 2%.

Laguna Beach 92651: $2.64 million — up 42%.

Villa Park 92861: $1.8 million — up 30%.

Newport Beach 92660: $1.76 million — off 17%.

Irvine 92602: $1.73 million — up 35%.

Irvine 92603: $1.59 million — up 37%.

Seal Beach 90740: $1.37 million — up 8%.

Los Alamitos 90720: $1.37 million — up 12%.

Irvine 92620: $1.35 million — up 27%.

Dana Point 92624: $1.31 million — up 4%.

Huntington Beach 92648: $1.26 million — up 9%.

Dana Point 92629: $1.26 million — up 3%.

Irvine 92618: $1.13 million — up 10%.

Santa Ana 92705: $1.11 million — up 6%.

Yorba Linda 92887: $1 million — off 1%.

O.C. ‘bargains’

And Orange County’s sub-$666,667 ZIPs …

Stanton 90680: $666,000 — up 45%.

Santa Ana 92704: $612,000 — up 23%.

Santa Ana 92701: $610,000 — up 47%.

Santa Ana 92703: $560,000 — off 1%.

Santa Ana 92707: $457,000 — off 5%.

Laguna Woods 92637: $410,000 — up 16%

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com

Related Articles

U.S. home price appreciation chill continued in October

Orange County homebuying, prices slip in November

Bubble watch: Will Fed rate hikes burst housing’s boom?

Southern California home prices set year’s 9th record

Chapman forecast says recession possible by 2023