“Bubble Watch” digs into trends that may indicate economic and/or housing market troubles ahead.

Buzz: California mortgage makers look “conservative” vs. national benchmarks.

Source: My trusty spreadsheet reviewed Black Knight’s report with noteworthy details from purchase and refi mortgages locked in during October. That stats track the 20 most-active housing markets — including five in California — and the nation.

The Trend

Lenders want better-financed borrowers in the Golden State when I compared averages for the state’s big markets vs. the other 15 metropolitan areas tracked as well as the nation overall.

Loan size: No surprise, California’s average mortgage is typically bigger — $537,289 vs. $373,009 for the other metros and $330,169 nationally.

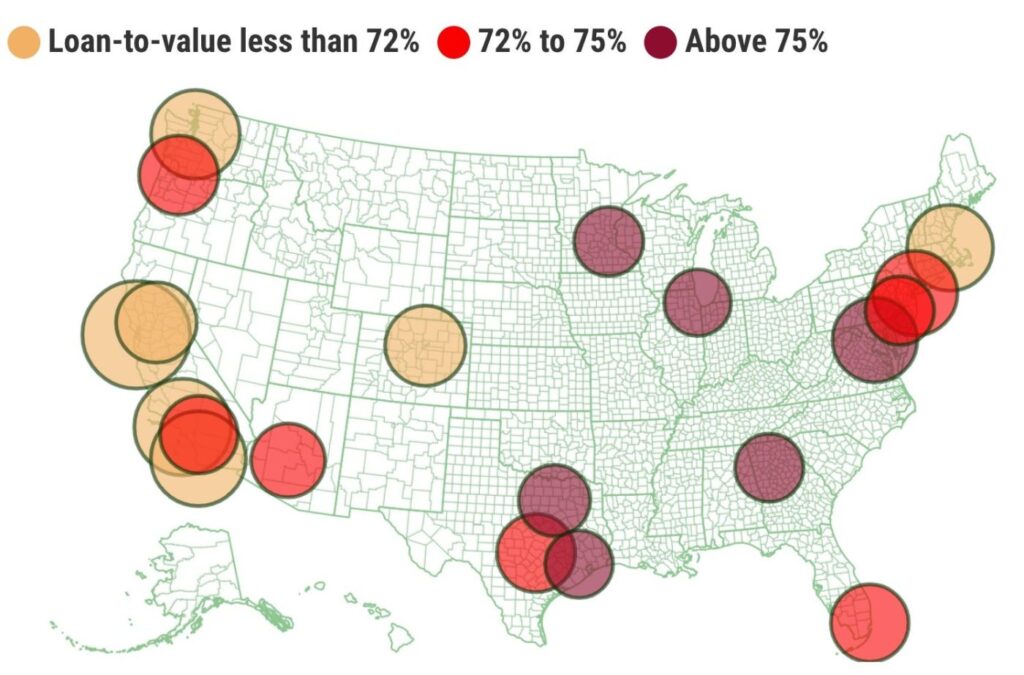

Loan-to-value: Bankers worry about the cushion between a mortgage’s size and what a home’s worth. In California, lending was at just 67% of a home’s value vs. 74% for the other metros and 76% for the nation. (To the borrower, the same math — reversed — is the downpayment or equity remaining. So 33% in California; 26% in other metros, 24% nationally.)

Credit score: California has stronger credit scores with a 742 average vs. 735 for the other metros and 730 nationally. These are all high-quality bill-payment histories.

Rate: California got better deals, perhaps reflecting lower risks: State borrowers locked in a 3.14% rate vs. 3.19% for the other metros and 3.21% nationally.

The Dissection

California loans are bigger and that alone can make lenders skittish. So bankers in October apparently wanted more protection in the form of larger downpayments from borrowers with better financial strength. In return, these well-to-do Californians get lower rates.

Look at the five Golden State markets to see the typical deal and the lowered risk-taking, with the Inland Empire a bit of an outlier …

San Francisco: $733,630 loan — the largest of the 20 metros — was equal to 63% of the home’s value, the lowest lending level. Borrowers had a 757 credit score, the highest. The loans had 3.12% average rates, fourth-lowest.

Los Angeles-Orange County: $591,827 loan (No. 2) with a 65% loan-to-value — second-lowest. The borrower had an average 743 credit score, the fourth-highest. Rate was 3.14%, the fifth-lowest.

San Diego: $568,763 loan (No. 3) with a 67% loan-to-value — third-lowest. The borrower had a 748 credit score, second-highest. Rate was 3.07%, second-lowest

Sacramento: $409,337 loan (No. 8) with a 70% loan-to-value, fifth-lowest. The borrower had a 739 credit score, No. 10. Rate was 3.17%, eighth-lowest.

Inland Empire: $382,888 loan (No. 12) with 72% loan-to-value, ninth-lowest. The borrower had a 722 credit score. Note: That’s tied with Atlanta for the lowest of the 20 metros. And the rate was 3.2%, seventh-highest.

How bubbly?

On a scale of zero bubbles (no bubble here) to five bubbles (five-alarm warning) … ONE BUBBLE!

Wild lending in California goes back to the Gold Rush days. So it’s stunning — and comforting — that these stats show Golden State bankers and borrowers appearing to be well-behaved, financially speaking, in this buying and refinancing binge.

But there’s a downside to this apparently limited risk-taking, too.

It makes it harder for anyone but folks with great finances and solid credit histories to buy a home.

And it makes me wonder … what are lenders worried about?

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at [email protected]

Related Articles

900 fired by Zoom: Mortgage staff shares how they were cut in a minute

Why can million-dollar homes get U.S. loan subsidies?

Are new loan limits for Fannie and Freddie too high?

Count your pandemic-related mortgage blessings

Bubble watch: California housing ‘affordability gap’ near pre-crash levels